State Farm auto insurance pay-per-mile sets the stage for a unique approach to car insurance. This program flips the script on traditional insurance models, offering drivers the potential for lower premiums based on how much they actually drive. It’s a concept that’s gaining traction, especially among those who clock fewer miles on the road.

Imagine this: You’re a stay-at-home parent, a remote worker, or someone who simply prefers public transportation or walking. With State Farm’s pay-per-mile program, your lower mileage could translate into lower insurance costs. The program works by using a mileage tracking device to monitor your driving habits, and your premiums are calculated based on the distance you cover.

This means that if you’re a low-mileage driver, you could potentially save a significant amount of money on your insurance.

State Farm Pay-Per-Mile Insurance: A Comprehensive Guide: State Farm Auto Insurance Pay-per-mile

In today’s world of rising insurance costs, many drivers are looking for ways to save money. One innovative solution gaining popularity is pay-per-mile insurance, where you pay for coverage based on how much you drive. State Farm, a leading insurance provider, offers such a program, and it’s worth exploring if you’re a low-mileage driver seeking cost-effective insurance options.

State Farm Pay-Per-Mile Program Overview, State Farm auto insurance pay-per-mile

State Farm’s pay-per-mile program, aptly named “Drive Safe & Save,” operates on a simple principle: the less you drive, the less you pay. This program targets individuals who drive fewer miles than the average driver, such as those who primarily use public transportation, work from home, or have short commutes.

- Benefits:The primary advantage is potential cost savings for low-mileage drivers. If you drive significantly less than the average, you could see a substantial reduction in your insurance premiums compared to traditional policies.

- Drawbacks:A key drawback is that pay-per-mile insurance may not be suitable for high-mileage drivers. If you drive frequently for work or leisure, your premiums could end up being higher than a traditional policy. Additionally, you need to accurately track your mileage, which can be inconvenient for some.

How Pay-Per-Mile Works

The mechanics of State Farm’s pay-per-mile program are relatively straightforward. To participate, you’ll need to install a small device in your car that tracks your mileage. This device, usually a small plug-in gadget, transmits your driving data to State Farm.

- Mileage Tracking:The device accurately records the distance you travel, providing State Farm with real-time data on your driving habits. This data is then used to calculate your premium based on the number of miles you drive.

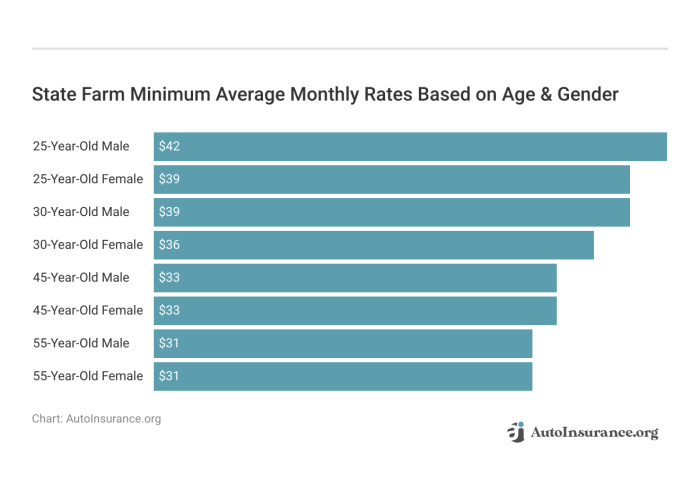

- Premium Calculation:State Farm calculates your premium based on your mileage and a predetermined base rate. The base rate is typically lower than traditional policies, and the premium is adjusted based on your actual mileage. For instance, you might pay a base rate plus a per-mile charge, with the per-mile charge varying depending on your mileage tier.

- Mileage Tiers:State Farm typically divides drivers into mileage tiers, with each tier having a corresponding premium rate. For example, a low-mileage tier might have a lower per-mile charge than a high-mileage tier. This tiered system ensures that drivers who drive fewer miles pay less for their insurance.

Advantages of Pay-Per-Mile Insurance

Pay-per-mile insurance offers several advantages, particularly for drivers who drive less than the average.

- Cost Savings:The most significant benefit is the potential for significant cost savings. If you drive significantly less than the average, you could save hundreds of dollars annually on your insurance premiums.

- Driving Habits:This program can be beneficial for drivers who have specific driving habits, such as those who primarily use public transportation, work from home, or have short commutes. These drivers often find themselves paying for coverage they don’t fully utilize.

- Cost Comparison:Compared to traditional insurance models, pay-per-mile insurance can be more cost-effective for low-mileage drivers. While traditional policies charge a flat premium based on factors like your vehicle, driving history, and location, pay-per-mile programs take into account your actual driving habits.

Considerations for Choosing Pay-Per-Mile

While pay-per-mile insurance can be advantageous, it’s essential to consider its potential drawbacks before making a decision.

- High Mileage:If you drive frequently for work or leisure, your premiums could end up being higher than a traditional policy. Pay-per-mile insurance is generally designed for low-mileage drivers, and exceeding a certain mileage threshold can lead to higher costs.

- Long-Distance Travel:If you frequently engage in long-distance travel, pay-per-mile insurance might not be the most cost-effective option. The higher mileage accumulated during these trips could significantly impact your premiums.

State Farm’s Pay-Per-Mile Program in Practice

Let’s illustrate how State Farm’s pay-per-mile program can work in real-world scenarios. Imagine two drivers, both with similar vehicles and driving histories, but with different mileage habits.

- Scenario 1:Driver A commutes a short distance to work, uses public transportation frequently, and enjoys occasional weekend trips. Their annual mileage is around 5,000 miles. Under State Farm’s pay-per-mile program, they would likely fall into a low-mileage tier, resulting in significantly lower premiums compared to a traditional policy.

- Scenario 2:Driver B works as a salesperson and drives long distances daily. Their annual mileage is around 20,000 miles. Under State Farm’s pay-per-mile program, they would likely fall into a high-mileage tier, potentially resulting in higher premiums than a traditional policy.

Here’s a table showcasing different mileage scenarios and their corresponding premium costs, illustrating the potential cost savings for low-mileage drivers.

| Mileage Tier | Annual Mileage | Premium Cost |

|---|---|---|

| Low Mileage | 5,000 miles | $500 |

| Medium Mileage | 10,000 miles | $800 |

| High Mileage | 15,000 miles | $1,200 |

To visualize how mileage tracking works within State Farm’s pay-per-mile program, imagine a simple illustration. Picture a car with a small device attached to its dashboard. This device continuously records the distance traveled, sending this data wirelessly to State Farm’s servers.

The servers then process this information, calculating your premium based on your mileage and the predetermined base rate.

State Farm’s pay-per-mile auto insurance is a great option for drivers who don’t rack up the miles, but what about those times when you’re in a fender bender? That’s where State Farm gap insurance coverage comes in handy, covering the difference between your car’s actual cash value and what you still owe on your loan.

So, if you’re a low-mileage driver who wants to save on insurance and have peace of mind, State Farm’s pay-per-mile program might be just the ticket!

Comparing Pay-Per-Mile Programs

State Farm isn’t the only insurer offering pay-per-mile insurance. Several other providers have their own programs, each with its unique features and pricing structure. It’s essential to compare different programs to find the best option for your needs.

- Program Differences:State Farm’s Drive Safe & Save program has a base rate plus a per-mile charge, with mileage tiers determining the per-mile cost. Other programs might have different base rates, per-mile charges, or mileage tiers. Some programs might offer discounts for safe driving or require a minimum mileage threshold.

- Advantages and Disadvantages:Compare the advantages and disadvantages of each program. Consider factors like mileage tracking methods, premium calculation formulas, and available discounts. Some programs might require a specific device, while others might allow you to use your smartphone for mileage tracking.

- Resources for Comparison:You can find information on different pay-per-mile insurance providers by contacting them directly, visiting their websites, or using online comparison tools. Insurance comparison websites often allow you to compare quotes from various providers, making it easier to find the best deal.

Ultimate Conclusion

State Farm’s pay-per-mile program presents an intriguing alternative for those who don’t rack up the miles. While it might not be the perfect fit for every driver, especially those who frequently hit the open road, it offers a refreshing perspective on car insurance.

By embracing a pay-per-mile model, State Farm is catering to a growing segment of drivers who are looking for more personalized and cost-effective insurance solutions.

FAQ Guide

How do I track my mileage with State Farm’s pay-per-mile program?

You can track your mileage using a smartphone app or a small device that plugs into your car’s diagnostic port.

Does State Farm’s pay-per-mile program work in all states?

No, it’s not available in every state. You can check State Farm’s website to see if it’s offered in your area.

Are there any mileage limits or caps in the State Farm pay-per-mile program?

Yes, there are typically mileage limits. You can find details about these limits on State Farm’s website or by contacting their customer service.