State Farm auto insurance premium calculator is your one-stop shop for understanding your potential insurance costs. This handy tool takes the guesswork out of budgeting, allowing you to see how factors like your driving history, car type, and location can influence your premiums.

Think of it as a crystal ball for your insurance, giving you a glimpse into your future costs.

The calculator is simple to use and provides a clear breakdown of the factors influencing your premium estimate. It’s like having a personal insurance advisor at your fingertips, helping you make informed decisions about your coverage and budget.

State Farm Auto Insurance Premium Calculator Overview

Navigating the world of auto insurance can feel like driving through a maze. With so many factors influencing your premium, it’s hard to know where to start. But don’t worry, State Farm has your back! Their online auto insurance premium calculator is a powerful tool that can help you estimate your potential insurance costs and make informed decisions about your coverage.

This handy calculator lets you quickly get a sense of what your auto insurance might cost, based on your individual circumstances. It’s like having a personal insurance advisor right at your fingertips!

Key Features and Benefits

- Estimate Your Costs in Minutes:Say goodbye to long phone calls and paperwork. The calculator allows you to input your information and receive an estimated premium within minutes.

- Personalized Results:The calculator takes into account your specific driving history, vehicle type, location, and coverage options, giving you a personalized estimate that reflects your unique needs.

- Compare Coverage Options:The calculator lets you explore different coverage levels and deductibles, so you can see how your choices impact your premium. This empowers you to find the right balance of protection and affordability.

- Free and Easy to Use:The calculator is free to use and accessible 24/7, allowing you to explore your options at your convenience.

Factors Influencing Auto Insurance Premiums

Your auto insurance premium isn’t just pulled out of a hat. It’s calculated based on a number of factors that reflect your risk profile. Here are some of the key factors that play a role:

Driving History

Your driving history is a major factor in determining your premium. A clean driving record with no accidents or violations will typically result in lower premiums. On the other hand, if you have a history of accidents, speeding tickets, or DUI convictions, your premiums will likely be higher.

Vehicle Type

The type of vehicle you drive also plays a role. Expensive, high-performance cars are generally more expensive to insure due to their higher repair costs and potential for theft. On the other hand, smaller, less expensive vehicles may have lower premiums.

Location

Where you live can also impact your premium. Areas with higher crime rates, traffic congestion, or more severe weather conditions tend to have higher insurance rates.

Coverage Options, State Farm auto insurance premium calculator

The amount of coverage you choose will also affect your premium. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums. However, they also provide greater financial protection in the event of an accident or theft.

Other Factors

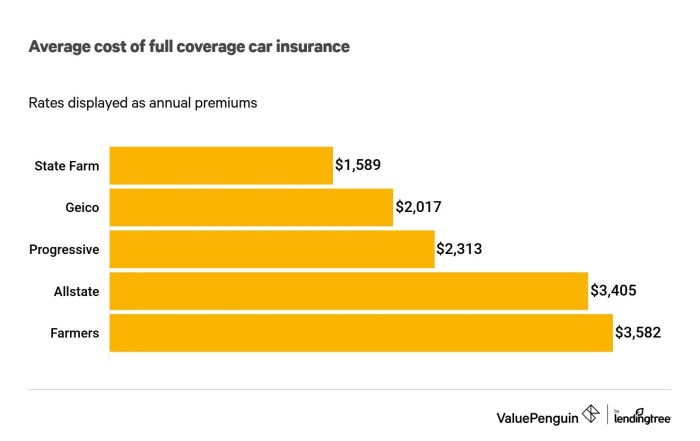

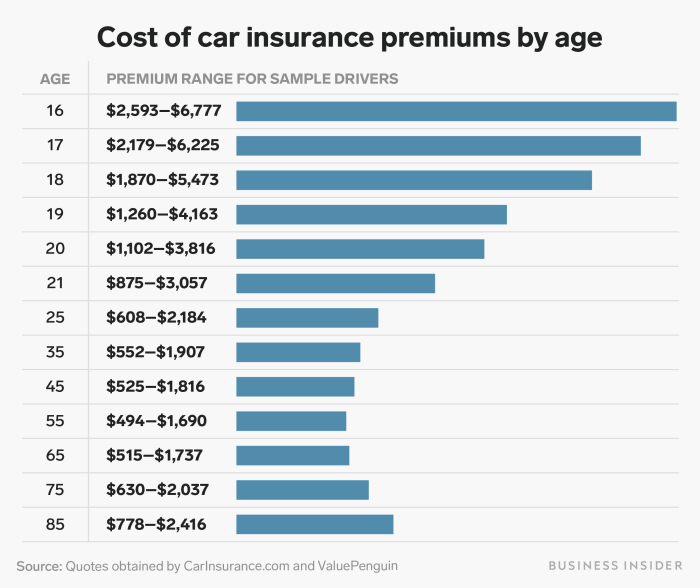

- Age and Gender:Younger drivers, especially males, often have higher premiums due to their higher risk of accidents.

- Credit Score:In some states, your credit score can be used to determine your premium. A good credit score can lead to lower premiums.

- Driving Habits:Factors like your annual mileage and whether you commute daily can also influence your premium.

Using the State Farm Auto Insurance Premium Calculator

Using the State Farm auto insurance premium calculator is as easy as taking a short drive. Here’s a step-by-step guide to help you get started:

Step-by-Step Guide

- Visit the State Farm Website:Head over to the State Farm website and navigate to the auto insurance section. You should find the premium calculator prominently displayed.

- Enter Your Information:The calculator will ask for basic information, such as your zip code, date of birth, and driving history. Be sure to provide accurate information to ensure a reliable estimate.

- Select Your Vehicle:You’ll need to provide details about your vehicle, including its year, make, model, and estimated value.

- Choose Your Coverage Options:The calculator will allow you to select the desired coverage levels, such as liability, collision, and comprehensive. You can also adjust the deductibles to see how they impact your premium.

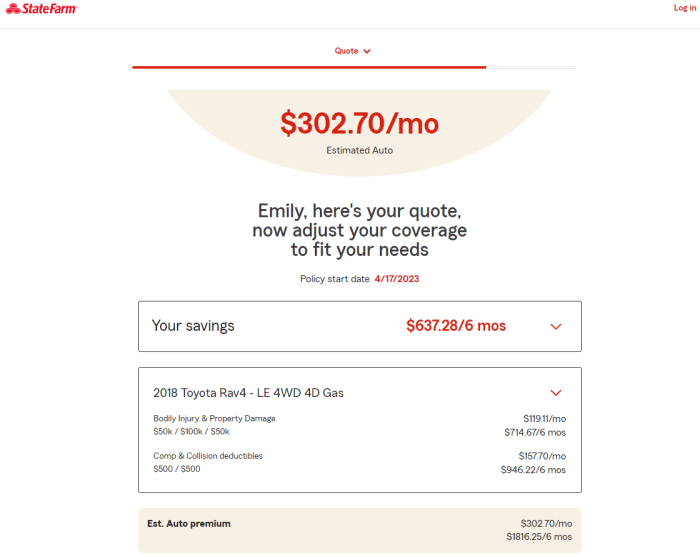

- Review Your Estimate:Once you’ve entered all the necessary information, the calculator will provide an estimated premium based on your specific circumstances.

Hypothetical Example

Let’s say you’re a 30-year-old driver with a clean driving record living in a suburban area. You drive a 2018 Honda Civic and are looking for liability coverage with a $500 deductible. After entering this information into the calculator, you might receive an estimated premium of $1,200 per year.

However, keep in mind that this is just an estimate, and your actual premium may vary based on a more detailed evaluation.

Understanding the Premium Estimate

The premium estimate provided by the calculator is a valuable tool for understanding your potential insurance costs. It’s broken down into different components, which can help you make informed decisions about your coverage.

Components of the Estimate

- Coverage Types:The estimate will show the cost of each coverage type you’ve selected, such as liability, collision, and comprehensive.

- Deductibles:The estimate will reflect the deductibles you’ve chosen. Remember that a higher deductible typically leads to a lower premium.

- Discounts:If you qualify for any discounts, such as good driver discounts or multi-policy discounts, the estimate will reflect those savings.

Comparing Coverage Options

The estimate can help you compare different coverage options and pricing. You can experiment with different coverage levels and deductibles to see how they impact your premium. This allows you to find the best balance of protection and affordability for your individual needs.

Not a Binding Quote

It’s important to remember that the premium estimate is not a binding quote. It’s simply a preliminary estimate based on the information you provided. A more detailed evaluation by a State Farm insurance agent will be necessary to determine your final premium.

Need to know how much your State Farm auto insurance will cost? Their online premium calculator is a lifesaver! Just like saying “Hello world!” Hello world! is the classic first step in programming, the State Farm calculator is your first step to getting the right coverage at the right price.

So, take a minute to plug in your info and see what you can save.

Additional Resources and Information

Ready to take the next step? State Farm provides a wealth of resources to help you get the insurance you need. Here are some helpful links and tips:

State Farm Resources

- State Farm Website:Visit the State Farm website for comprehensive information about their auto insurance policies, FAQs, and online tools.

- Customer Service:Contact State Farm customer service for personalized assistance and to answer any questions you may have.

Getting a Personalized Quote

After using the premium calculator, you can request a personalized quote from a State Farm insurance agent. They will review your specific circumstances in detail and provide you with a tailored quote that reflects your individual needs.

Consult with an Agent

For the most accurate and personalized advice, it’s highly recommended to consult with a State Farm insurance agent. They can help you understand your coverage options, explain the different factors influencing your premium, and ensure you have the right protection for your vehicle and your peace of mind.

Closing Notes: State Farm Auto Insurance Premium Calculator

Armed with the knowledge from the State Farm auto insurance premium calculator, you can confidently navigate the world of car insurance. Remember, the estimate is a starting point. To get a personalized quote, reach out to a State Farm agent who can tailor a policy to your specific needs and driving habits.

So, buckle up and get ready to drive into the future with peace of mind and a clear understanding of your insurance costs.

FAQ Explained

Is the premium estimate from the calculator a binding quote?

No, the estimate is not a binding quote. It’s a starting point to help you understand your potential costs. To get a personalized quote, you’ll need to contact a State Farm agent.

What if I don’t have all the information needed for the calculator?

Don’t worry! You can still use the calculator and provide as much information as you have. The calculator will provide an estimate based on the information you enter.

Can I use the calculator to compare different coverage options?

Absolutely! The calculator allows you to adjust your coverage options and see how they affect your premium estimate. This helps you find the right balance of coverage and cost.