State Farm collision and comprehensive coverage are like your car’s personal superheroes, ready to swoop in and save the day when unexpected mishaps occur. Whether it’s a fender bender or a hailstorm, these coverages are your financial safety net, ensuring you can get back on the road quickly and without breaking the bank.

Collision coverage steps in when your car collides with another vehicle or object, like a tree or a telephone pole. It helps pay for repairs or replacement, minus your deductible, of course. Comprehensive coverage, on the other hand, is your shield against the unexpected, covering damage caused by events like theft, vandalism, fire, or even falling objects.

It’s like having a guardian angel for your car!

State Farm Collision Coverage

Collision coverage is a vital component of comprehensive car insurance that protects you financially in the event of an accident involving your vehicle. It covers the cost of repairs or replacement of your car if it’s damaged in a collision with another vehicle or object, regardless of who’s at fault.

Types of Accidents Covered by Collision Coverage

Collision coverage extends protection to a wide range of accidents, including:

- Rear-end collisions:When your car is struck from behind by another vehicle.

- Head-on collisions:When your car collides with another vehicle directly.

- Side-impact collisions:When your car is hit on the side by another vehicle.

- Single-vehicle accidents:When your car crashes into a stationary object, such as a tree or a pole.

- Rollover accidents:When your car flips over.

Factors Determining the Cost of Collision Coverage

The cost of collision coverage varies depending on several factors, including:

- Your vehicle’s make, model, and year:Newer and more expensive vehicles generally have higher collision coverage premiums.

- Your driving history:Drivers with a history of accidents or traffic violations typically pay higher premiums.

- Your location:Collision coverage premiums can vary depending on the geographic area where you live.

- Your deductible:A higher deductible means lower premiums, but you’ll pay more out of pocket if you need to file a claim.

Examples of Collision Coverage Applications

Collision coverage is crucial in situations like:

- A fender bender with another vehicle:Collision coverage will help pay for repairs to your car, even if you’re not at fault.

- Hitting a parked car:Collision coverage will cover the cost of repairs to your vehicle, regardless of who was at fault.

- Running into a tree or pole:Collision coverage will help pay for repairs or replacement of your car, even if the accident was caused by a weather event.

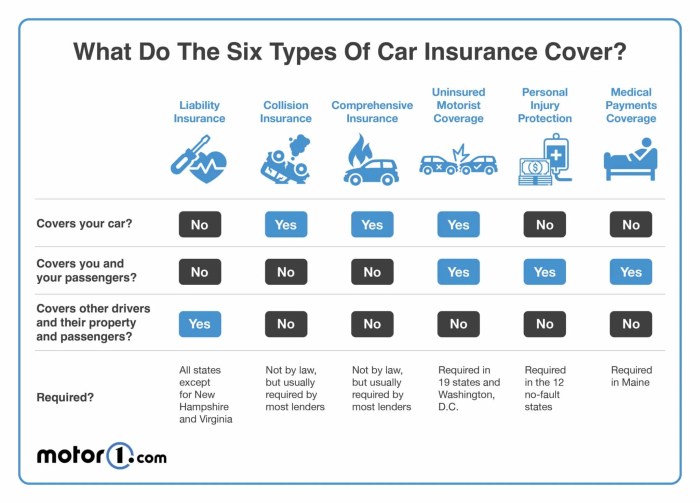

Comparison of Collision Coverage with Other Car Insurance Types

| Type of Coverage | Description | Coverage |

|---|---|---|

| Collision Coverage | Covers damage to your vehicle in an accident with another vehicle or object. | Damage to your vehicle, regardless of fault. |

| Liability Coverage | Protects you financially if you’re at fault in an accident that causes injury or damage to others. | Injury or damage to others, up to the policy limits. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. | Damage to your vehicle from non-collision events. |

| Uninsured/Underinsured Motorist Coverage | Protects you financially if you’re involved in an accident with an uninsured or underinsured driver. | Injury or damage to you, up to the policy limits. |

State Farm Comprehensive Coverage: State Farm Collision And Comprehensive Coverage

Comprehensive coverage is an essential part of your car insurance policy that safeguards your vehicle against a wide range of perils beyond collisions. It protects you financially from losses caused by incidents like theft, vandalism, natural disasters, and other unexpected events.

Events Covered by Comprehensive Coverage, State Farm collision and comprehensive coverage

Comprehensive coverage extends protection to your vehicle against a variety of events, including:

- Theft:If your car is stolen, comprehensive coverage will help replace or repair it.

- Vandalism:Damage caused by vandalism, such as broken windows or graffiti, is covered by comprehensive coverage.

- Natural disasters:Comprehensive coverage protects your car against damage from events like floods, earthquakes, hailstorms, and wildfires.

- Fire:If your car is damaged or destroyed by fire, comprehensive coverage will provide financial assistance.

- Falling objects:Damage caused by objects falling onto your car, such as tree branches or debris, is covered by comprehensive coverage.

- Animal collisions:If your car is damaged in a collision with an animal, comprehensive coverage can help with repairs or replacement.

Deductibles and Coverage Limits in Comprehensive Coverage

Like collision coverage, comprehensive coverage has a deductible, which is the amount you pay out of pocket before your insurance kicks in. Your coverage limit determines the maximum amount your insurer will pay for repairs or replacement of your vehicle.

Benefits of Having Comprehensive Coverage

Comprehensive coverage offers significant benefits, such as:

- Peace of mind:Knowing that your car is protected against a wide range of risks can provide peace of mind.

- Financial protection:Comprehensive coverage helps you avoid substantial out-of-pocket expenses in the event of a covered incident.

- Replacement or repair:Comprehensive coverage can help you replace or repair your car if it’s damaged beyond repair.

Key Differences Between Collision and Comprehensive Coverage

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers damage to your vehicle in an accident with another vehicle or object. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. |

Combining Collision and Comprehensive Coverage

Combining collision and comprehensive coverage offers a comprehensive safety net for your vehicle, protecting you financially from a wide range of risks. These coverages work in tandem to provide complete protection, ensuring you’re covered for both accidents and non-collision events.

Advantages of Having Both Coverages

The advantages of combining collision and comprehensive coverage are numerous:

- Complete protection:You’re covered for both accidents and non-collision events, ensuring financial security in various scenarios.

- Peace of mind:Knowing that your car is protected against a wide range of risks can provide peace of mind.

- Financial security:Having both coverages can help you avoid significant out-of-pocket expenses in the event of an incident.

Complementarity of Collision and Comprehensive Coverage

Collision and comprehensive coverage complement each other by providing a comprehensive safety net for your vehicle. While collision coverage safeguards you in accidents, comprehensive coverage protects you from non-collision events, ensuring that you’re covered regardless of the cause of damage to your car.

Scenarios Where Both Coverages Are Crucial

In situations like:

- A collision with another vehicle:Collision coverage will help pay for repairs or replacement of your car.

- A hail storm causing damage to your car:Comprehensive coverage will cover the cost of repairs.

- Your car being stolen:Comprehensive coverage will help replace your stolen vehicle.

Understanding Coverage Limits and Deductibles

It’s crucial to understand the coverage limits and deductibles associated with both collision and comprehensive coverage. Coverage limits determine the maximum amount your insurer will pay for repairs or replacement, while deductibles represent the amount you pay out of pocket before your insurance kicks in.

Choosing the right coverage limits and deductibles is essential to ensure adequate financial protection without excessive premiums.

Potential Costs and Benefits of Combining Collision and Comprehensive Coverage

| Coverage Type | Cost | Benefits |

|---|---|---|

| Collision Coverage | Higher premiums due to the higher risk of accidents. | Covers damage to your vehicle in an accident with another vehicle or object. |

| Comprehensive Coverage | Lower premiums than collision coverage due to the lower risk of non-collision events. | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. |

| Combined Collision and Comprehensive Coverage | Higher premiums than either coverage alone. | Provides complete protection for your vehicle against both accidents and non-collision events. |

State Farm’s Approach to Collision and Comprehensive Coverage

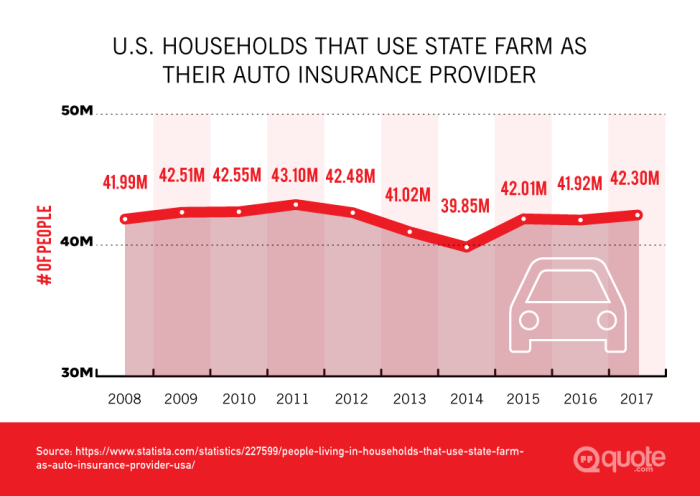

State Farm, a leading insurance provider, offers comprehensive collision and comprehensive coverage options designed to protect your vehicle and your financial well-being. State Farm’s approach to these coverages is characterized by its commitment to customer satisfaction and its focus on providing comprehensive protection.

State Farm’s Collision and Comprehensive Coverage Policies

State Farm’s collision and comprehensive coverage policies are designed to provide financial protection in the event of an accident or a non-collision event. These policies offer various coverage options, deductibles, and limits to cater to individual needs and budgets.

Benefits and Limitations of State Farm’s Coverage Options

State Farm’s collision and comprehensive coverage options offer numerous benefits, such as:

- Comprehensive protection:State Farm’s coverage options protect your vehicle against a wide range of risks.

- Flexible options:State Farm offers various coverage options, deductibles, and limits to cater to individual needs.

- Excellent customer service:State Farm is known for its excellent customer service and support.

However, there are also some limitations to consider:

- Premium costs:State Farm’s premiums may be higher than those of some other insurers.

- Deductibles:State Farm’s deductibles may be higher than those of some other insurers.

Comparison with Other Major Insurance Providers

State Farm’s collision and comprehensive coverage offerings are competitive with those of other major insurance providers. However, it’s essential to compare quotes from multiple insurers to find the best coverage and price for your needs.

Key Features of State Farm’s Collision and Comprehensive Coverage

| Feature | Description |

|---|---|

| Coverage Options | State Farm offers various coverage options, deductibles, and limits to cater to individual needs. |

| Deductibles | State Farm offers a range of deductibles to choose from, allowing you to balance premium costs and out-of-pocket expenses. |

| Coverage Limits | State Farm offers various coverage limits to protect your vehicle’s value. |

| Customer Service | State Farm is known for its excellent customer service and support. |

Considerations for Choosing Collision and Comprehensive Coverage

Choosing the right collision and comprehensive coverage levels is crucial for protecting your vehicle and your financial well-being. It involves considering your individual risk profile, your budget, and the value of your car.

Factors to Consider

When choosing collision and comprehensive coverage, consider these factors:

- Your driving history:Drivers with a history of accidents or traffic violations may need higher coverage levels.

- Your vehicle’s value:If your car is worth more, you may need higher coverage limits.

- Your budget:Higher coverage levels come with higher premiums, so it’s essential to consider your budget.

- Your risk tolerance:If you’re risk-averse, you may prefer higher coverage levels.

Assessing Individual Risk Profiles

It’s essential to assess your individual risk profile to determine the appropriate coverage levels. Factors like your driving history, the value of your car, and your location can influence your risk profile.

Choosing the Right Coverage Levels

Follow these steps to choose the right coverage levels:

- Assess your risk profile:Consider your driving history, the value of your car, and your location.

- Determine your budget:Decide how much you can afford to pay in premiums.

- Compare quotes:Obtain quotes from multiple insurers to find the best coverage and price.

- Choose the right coverage levels:Select coverage levels that provide adequate protection without exceeding your budget.

Obtaining Competitive Quotes

To obtain competitive quotes, follow these tips:

- Compare quotes from multiple insurers:Don’t settle for the first quote you receive.

- Be clear about your needs:Tell insurers your specific coverage requirements and budget.

- Ask about discounts:Inquire about available discounts, such as good driver discounts or safe driver discounts.

Decision-Making Process for Selecting Coverage

Use this flowchart to guide your decision-making process:

[Flowchart illustration depicting the decision-making process for selecting coverage]

Summary

So, whether you’re a seasoned driver or just starting out, understanding State Farm’s collision and comprehensive coverage is essential. By carefully considering your needs and budget, you can choose the right level of protection for your vehicle and drive with peace of mind, knowing you’re covered from unexpected bumps in the road.

Remember, it’s always better to be safe than sorry!

FAQ Guide

What’s the difference between collision and comprehensive coverage?

Collision coverage protects you from damage caused by a collision with another vehicle or object, while comprehensive coverage covers damage from other events like theft, vandalism, or natural disasters.

Do I really need both collision and comprehensive coverage?

The answer depends on your individual circumstances and the value of your car. If you have a newer car with a loan or lease, it’s usually a good idea to have both. If you have an older car with a lower value, you might consider dropping one or both.

How do deductibles affect my coverage?

Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible means lower premiums, but you’ll pay more if you need to file a claim. A lower deductible means higher premiums, but you’ll pay less if you need to file a claim.

How do I know if I’m getting the right coverage?

State Farm’s collision and comprehensive coverage are lifesavers for your everyday car, but what about your prized possession, your luxury ride? For that, you’ll want to explore the State Farm luxury car insurance policy , which offers specialized coverage for your high-end vehicle.

From collision repairs to theft protection, it’s designed to keep your luxury car gleaming and running smoothly. So, whether you’re cruising in a classic convertible or a sleek sedan, make sure you’re properly protected with State Farm’s collision and comprehensive coverage options.

It’s always a good idea to speak with a State Farm agent to discuss your specific needs and get personalized advice. They can help you determine the best coverage options for your situation.