State Farm full coverage auto insurance offers a comprehensive shield against financial hardship in the event of an accident. It goes beyond the bare minimum, providing peace of mind knowing you’re covered for a wide range of situations. From collisions and comprehensive damage to liability and medical expenses, this policy acts as a safety net for your vehicle and your wallet.

But what exactly does full coverage entail? It’s a combination of different types of insurance, each designed to protect you in specific scenarios. We’ll delve into the details, exploring the benefits, costs, and key components of State Farm’s full coverage auto insurance.

State Farm Full Coverage Auto Insurance: Overview

If you’re looking for comprehensive protection for your vehicle, State Farm’s full coverage auto insurance might be a good option for you. Full coverage insurance provides financial protection against a wide range of risks, ensuring you’re covered in case of accidents, theft, or other unexpected events.

State Farm is a renowned insurance provider known for its reliable coverage and customer service. This article will delve into the details of State Farm’s full coverage auto insurance, outlining its benefits, coverage components, costs, and claim process.

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a type of insurance policy that combines various types of coverage to provide comprehensive protection for your vehicle. It’s designed to cover a broad range of risks, including accidents, theft, vandalism, and natural disasters. While the term “full coverage” may sound like it covers everything, it’s important to understand that it’s not truly all-encompassing.

Some situations, like wear and tear or intentional damage, may not be covered.

State Farm Full Coverage Auto Insurance

State Farm’s full coverage auto insurance policy encompasses a comprehensive set of coverages designed to protect your vehicle and your financial interests. This policy typically includes the following types of coverage:

- Liability Coverage:This coverage protects you financially if you cause an accident that results in injuries or damage to other people or their property. It covers bodily injury liability and property damage liability.

- Collision Coverage:This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It covers damage from collisions with other vehicles, objects, or even hitting a pothole.

- Comprehensive Coverage:This coverage provides protection against damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It helps cover the cost of repairs or replacement.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical expenses and vehicle damage.

- Personal Injury Protection (PIP):This coverage, also known as no-fault insurance, helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. It’s often required in certain states.

Benefits of State Farm Full Coverage Auto Insurance

Choosing State Farm’s full coverage auto insurance offers numerous advantages, providing peace of mind and financial protection in various situations. Here are some key benefits:

- Comprehensive Protection:Full coverage insurance provides a broad range of protection, safeguarding you from a wide array of risks. It covers accidents, theft, vandalism, and other unforeseen events, ensuring you’re financially secure.

- Financial Security:In the event of an accident or other covered incident, full coverage insurance helps cover the costs of repairs, replacement, medical expenses, and lost wages. It prevents you from bearing the financial burden alone.

- Peace of Mind:Knowing that you have comprehensive insurance coverage can alleviate stress and worry, allowing you to drive with confidence. You can focus on your journey without the constant concern of unexpected financial setbacks.

- Legal Protection:Full coverage insurance includes liability coverage, which provides legal protection in case you’re involved in an accident that results in injuries or property damage. It helps cover legal fees and settlements.

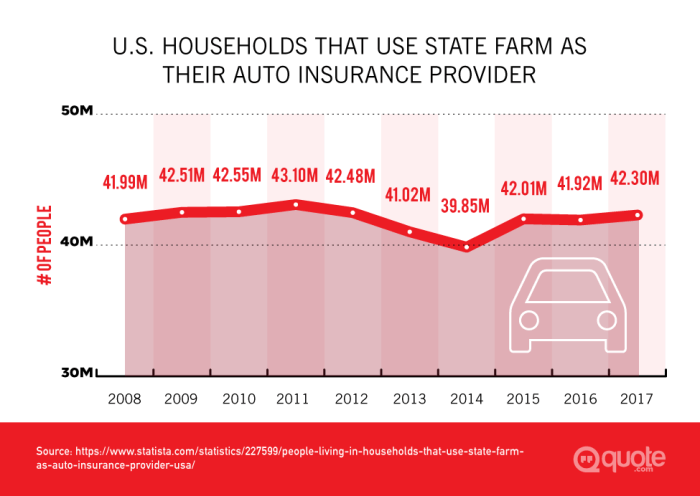

- State Farm’s Reputation:State Farm is a well-established and reputable insurance provider with a long history of customer satisfaction. Their strong financial stability and commitment to customer service provide reassurance and peace of mind.

Real-World Scenarios

Here are some real-world scenarios where full coverage insurance provides significant protection:

- Accident with another vehicle:If you’re involved in an accident that damages your vehicle, collision coverage helps pay for repairs or replacement. Liability coverage also comes into play if you’re at fault, covering the other driver’s injuries and property damage.

- Vehicle theft:If your vehicle is stolen, comprehensive coverage helps cover the cost of replacing it. It also provides coverage for any belongings that were stolen from your vehicle.

- Vandalism:If your vehicle is vandalized, comprehensive coverage helps cover the cost of repairs. It also covers damage from events like hailstorms, floods, and other natural disasters.

- Uninsured/Underinsured Motorist Accident:If you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage, uninsured/underinsured motorist coverage helps cover your medical expenses and vehicle damage.

Comparison with Other Coverage Options

| Coverage Option | Benefits | Disadvantages |

|---|---|---|

| Full Coverage | Comprehensive protection against a wide range of risks, including accidents, theft, vandalism, and natural disasters. Financial security in case of covered incidents. Peace of mind. Legal protection. | Higher premiums compared to other coverage options. May not be necessary for older vehicles with low market value. |

| Liability Only | Lower premiums compared to full coverage. Meets legal requirements in most states. | Limited coverage. Doesn’t cover damage to your own vehicle. No protection against theft, vandalism, or other non-collision events. |

| Collision Only | Covers damage to your vehicle in accidents, regardless of fault. | Doesn’t cover damage from non-collision events like theft, vandalism, or natural disasters. |

Key Coverage Components

State Farm’s full coverage auto insurance policy includes several key coverage components that provide comprehensive protection for your vehicle and your financial interests. Each component has specific coverage limits and deductibles that determine how much you’ll pay out of pocket before insurance kicks in.

Liability Coverage

Liability coverage is a crucial component of full coverage insurance. It protects you financially if you cause an accident that results in injuries or damage to other people or their property. It typically includes two main parts:

- Bodily Injury Liability:This coverage helps pay for medical expenses, lost wages, and other damages related to injuries sustained by other people in an accident you caused.

- Property Damage Liability:This coverage helps pay for repairs or replacement of the other driver’s vehicle or property if you damage it in an accident.

The coverage limits for liability coverage are typically expressed in a combination of numbers, such as 100/300/100. This means your policy provides up to $100,000 in coverage per person for bodily injury, up to $300,000 in total coverage for all bodily injuries in an accident, and up to $100,000 for property damage.

It’s important to note that these limits can vary depending on your state and individual policy.

Collision Coverage

Collision coverage is another essential component of full coverage insurance. It helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. This coverage applies to collisions with other vehicles, objects, or even hitting a pothole.

The coverage limit for collision coverage is typically the actual cash value (ACV) of your vehicle, which is its market value before the accident. You’ll typically have to pay a deductible, which is a fixed amount you pay out of pocket before insurance kicks in.

For example, if your deductible is $500 and the cost of repairs is $2,000, you’ll pay $500 and State Farm will cover the remaining $1,500.

Comprehensive Coverage

Comprehensive coverage provides protection against damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It helps cover the cost of repairs or replacement.

State Farm full coverage auto insurance offers peace of mind, protecting you from the unexpected. But before you dive into the details, take a moment to say “Hello world!” Hello world! After all, it’s the little things that make life a little brighter.

Then, you can get back to exploring the benefits of State Farm full coverage auto insurance, and how it can help you feel secure on the road.

Like collision coverage, the coverage limit for comprehensive coverage is typically the actual cash value (ACV) of your vehicle. You’ll also have to pay a deductible, which can be the same as your collision deductible or a different amount.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical expenses and vehicle damage.

The coverage limits for uninsured/underinsured motorist coverage are typically the same as your liability coverage limits. However, some states have minimum coverage requirements for this type of insurance.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. It’s often required in certain states.

PIP coverage typically has a specific coverage limit, such as $10,000 or $25,000. It may also have a deductible that you’ll have to pay before insurance kicks in.

Cost and Factors Influencing Premiums

The cost of State Farm full coverage auto insurance can vary significantly depending on a number of factors. Understanding these factors can help you estimate your premium and make informed decisions about your coverage.

Factors Affecting Premium Costs

- Vehicle Type and Value:The make, model, year, and value of your vehicle play a significant role in determining your premium. Higher-value vehicles typically have higher premiums because they’re more expensive to repair or replace.

- Driving History:Your driving record, including accidents, traffic violations, and driving history, is a major factor in premium calculations. Drivers with a clean record typically pay lower premiums than those with a history of accidents or violations.

- Location:Your location can affect your premium due to factors such as population density, traffic volume, and crime rates. Areas with higher risk factors typically have higher premiums.

- Age and Gender:Younger and inexperienced drivers often pay higher premiums than older, more experienced drivers. Gender can also play a role in some states, with women sometimes paying lower premiums than men.

- Coverage Limits and Deductibles:The coverage limits and deductibles you choose can significantly impact your premium. Higher coverage limits and lower deductibles generally result in higher premiums.

- Discounts:State Farm offers various discounts that can lower your premium. These discounts can be based on factors such as good driving history, safety features in your vehicle, bundling insurance policies, or being a member of certain organizations.

Impact of Factors on Premium Calculations

| Factor | Impact on Premium |

|---|---|

| Higher-value vehicle | Higher premium |

| Clean driving record | Lower premium |

| High-risk location | Higher premium |

| Younger driver | Higher premium |

| Higher coverage limits | Higher premium |

| Lower deductible | Higher premium |

| Discounts | Lower premium |

Claim Process and Customer Service

Filing a claim with State Farm full coverage insurance is a straightforward process. Here’s a general overview:

- Contact State Farm:You can file a claim by calling State Farm’s customer service line, using their online portal, or visiting a local agent.

- Provide Information:You’ll need to provide details about the accident or incident, including the date, time, location, and any other relevant information.

- Submit Documentation:State Farm may request documentation such as a police report, photos of the damage, and medical records.

- Claim Review and Approval:State Farm will review your claim and determine if it’s covered under your policy.

- Claim Settlement:If your claim is approved, State Farm will work with you to settle the claim. This may involve paying for repairs, replacement, medical expenses, or other covered costs.

Customer Testimonials and Reviews

State Farm is known for its customer-centric approach and efficient claim handling process. Numerous customer testimonials and reviews highlight their positive experiences with State Farm’s claim process. Customers often praise the company’s responsiveness, professionalism, and commitment to resolving claims fairly and promptly.

Customer Service Channels

State Farm offers various customer service channels to ensure accessibility and convenience. You can reach them by phone, email, online chat, or through their mobile app. Their website also provides a wealth of information about their policies, services, and claim process.

Comparisons and Alternatives

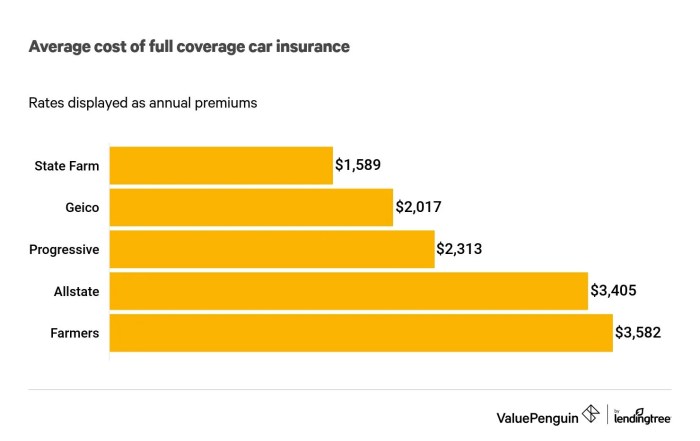

While State Farm is a leading insurance provider, it’s always a good idea to compare different options before making a decision. Here’s a comparison of State Farm full coverage insurance to similar offerings from other insurance providers:

Comparison with Other Providers

State Farm’s full coverage insurance is generally competitive in terms of price and coverage options. However, it’s important to compare quotes from multiple insurance providers to find the best deal for your specific needs. Some other well-known providers that offer full coverage auto insurance include:

- Geico:Known for its affordable rates and convenient online services.

- Progressive:Offers a wide range of coverage options and discounts.

- Allstate:Emphasizes customer service and personalized insurance solutions.

Advantages and Disadvantages of Choosing State Farm

Here are some advantages and disadvantages of choosing State Farm over other options:

Advantages

- Strong financial stability and reputation:State Farm is a financially sound company with a long history of reliability and customer satisfaction.

- Wide range of coverage options:State Farm offers a comprehensive suite of coverage options to meet various needs.

- Excellent customer service:State Farm is known for its responsive and helpful customer service.

- Availability of discounts:State Farm offers numerous discounts that can lower your premium.

Disadvantages

- Premiums may be higher than some competitors:While State Farm’s premiums are generally competitive, they may be higher than some other providers.

- Limited online services:State Farm’s online services may not be as extensive as some other providers.

Alternative Insurance Solutions

For specific needs or situations, alternative insurance solutions may be more suitable. For example, if you have a high-value vehicle or a unique driving situation, you may consider specialized insurance providers that cater to those needs. You can also explore other insurance options, such as:

- Usage-based insurance:This type of insurance tracks your driving habits and offers lower premiums for safe drivers.

- Group insurance:Some organizations offer group insurance plans to their members, which may provide lower premiums.

Additional Considerations

When choosing State Farm full coverage auto insurance, it’s essential to understand the policy terms and conditions to ensure you’re fully protected. Here are some additional considerations:

Understanding Policy Terms and Conditions, State Farm full coverage auto insurance

Carefully review your policy documents to understand the specific terms and conditions, including coverage limits, deductibles, exclusions, and limitations. This will help you avoid surprises and ensure you’re aware of your rights and responsibilities.

Discounts and Add-ons

State Farm offers various discounts and add-ons that can customize your coverage and potentially lower your premium. These include discounts for good driving history, safety features, bundling insurance policies, and being a member of certain organizations. You can also consider adding optional coverage like roadside assistance or rental car reimbursement.

Maximizing Benefits

To maximize the benefits of State Farm full coverage insurance, consider these tips:

- Maintain a clean driving record:Avoid accidents and traffic violations to keep your premiums low.

- Take advantage of discounts:Explore all available discounts to lower your premium.

- Review your policy regularly:As your needs change, review your policy and adjust coverage as needed.

- File claims promptly:Don’t delay in filing claims to ensure timely processing and settlement.

- Communicate with State Farm:Keep State Farm informed of any changes in your situation, such as a change of address or vehicle ownership.

Final Wrap-Up

Ultimately, choosing State Farm full coverage auto insurance means taking a proactive approach to your financial security on the road. By understanding the coverage components, weighing the costs, and considering your individual needs, you can make an informed decision that aligns with your driving habits and financial goals.

Whether you’re a seasoned driver or just starting out, knowing your options empowers you to drive with confidence and peace of mind.

FAQ Corner: State Farm Full Coverage Auto Insurance

How much does State Farm full coverage auto insurance cost?

The cost of State Farm full coverage auto insurance varies based on factors like your driving history, vehicle type, location, and coverage options. It’s best to get a personalized quote from State Farm to determine your specific premium.

What are the main differences between State Farm full coverage and liability insurance?

Liability insurance covers damages to other people and their property in an accident. Full coverage includes liability plus additional coverage for your own vehicle, such as collision and comprehensive coverage.

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including safe driving discounts, good student discounts, multi-car discounts, and more. Contact your local State Farm agent to explore available discounts.