State Farm gap insurance coverage can be a lifesaver if you’re ever in a car accident or your vehicle is stolen. Imagine this: you’re driving your shiny new car, and suddenly, BAM! A fender bender happens. Your insurance pays out, but it only covers the actual cash value of your car, which is less than what you owe on the loan.

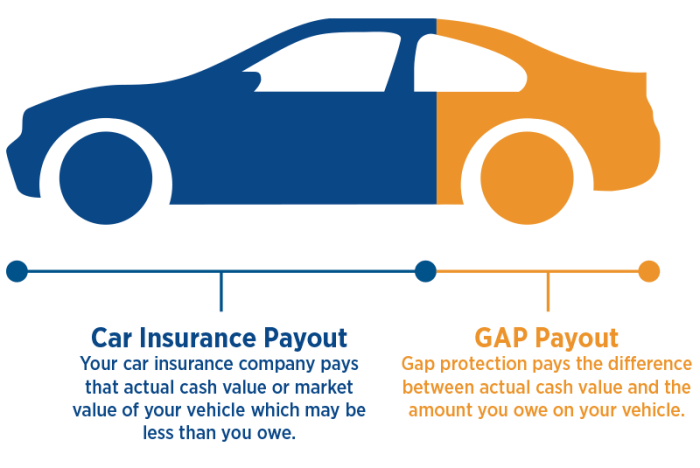

That’s where gap insurance steps in, bridging the gap between what you owe and what your insurance pays out. This coverage can save you from a huge financial burden, preventing you from being upside down on your loan.

Gap insurance is particularly helpful if you’ve financed your car for a longer term or have a high loan amount. It’s also beneficial if you’ve made a large down payment, as the actual cash value of your car will depreciate faster than the loan amount.

By understanding how gap insurance works and its benefits, you can make an informed decision about whether it’s right for you.

What is State Farm Gap Insurance?

State Farm Gap Insurance is a type of insurance that can help you cover the difference between the actual cash value of your vehicle and the amount you still owe on your auto loan or lease. This can be particularly beneficial in situations where your vehicle is totaled or stolen, and the insurance payout doesn’t fully cover the remaining loan balance.

Purpose of State Farm Gap Insurance

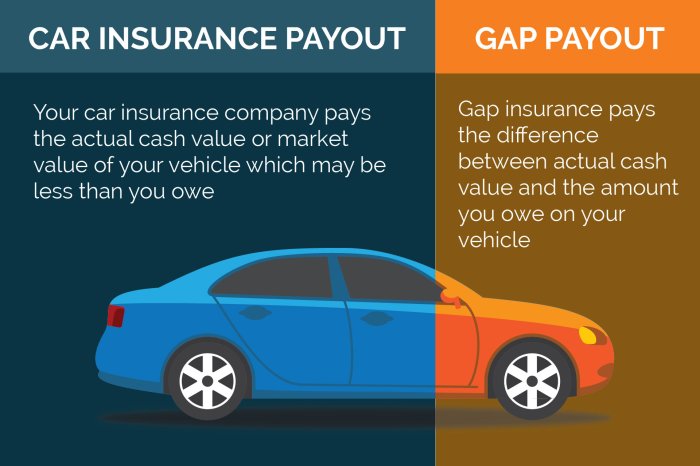

The purpose of State Farm Gap Insurance is to bridge the financial gap that can occur when your vehicle is damaged beyond repair or stolen. In these situations, your insurance company will typically pay the actual cash value (ACV) of your vehicle, which is the market value of the vehicle based on its age, mileage, and condition.

However, if you still owe more on your loan than the ACV, you’ll be responsible for the difference.

Scenarios Where Gap Insurance is Beneficial

Gap Insurance can be particularly beneficial in several scenarios, including:

- You financed your vehicle for a longer term, which can result in a higher loan balance.

- You purchased a new or nearly new vehicle, which depreciates quickly in value.

- You have a loan with a high interest rate, which can increase the total amount you owe.

- You have a loan with a negative equity balance, which means you owe more than the vehicle is worth.

Examples of Situations Where Gap Insurance Covers the Difference

Here are some examples of situations where Gap Insurance can cover the difference between the actual cash value and the loan amount:

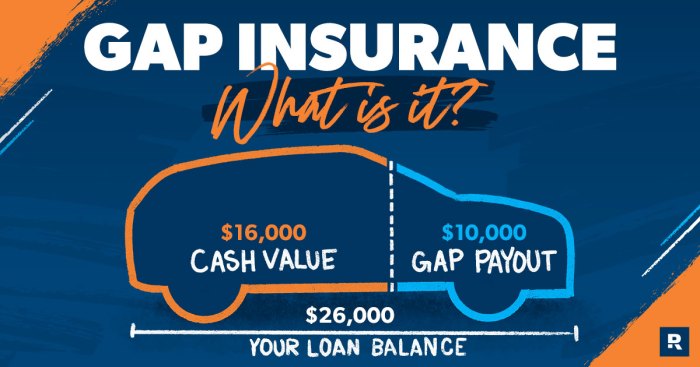

- You financed a new car for $30,000 and it’s totaled in an accident. The insurance company determines the actual cash value to be $20,000. Gap Insurance would cover the remaining $10,000 you still owe on the loan.

- You leased a car for $40,000 and it’s stolen. The insurance company pays the lease buyout amount, which is $35,000. Gap Insurance would cover the remaining $5,000 you owe on the lease.

How Does State Farm Gap Insurance Work?

State Farm Gap Insurance works by calculating the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease. This difference is known as the “gap” amount. If your vehicle is totaled or stolen, State Farm will pay the gap amount to cover the remaining balance.

Calculating the Gap Amount

The gap amount is calculated by subtracting the actual cash value (ACV) of your vehicle from the amount you still owe on your loan or lease. For example, if your vehicle is worth $15,000 and you owe $20,000 on your loan, the gap amount would be $5,000.

Determining the Actual Cash Value, State Farm gap insurance coverage

State Farm determines the actual cash value of your vehicle based on its age, mileage, condition, and market value. They may use various sources to determine the ACV, including:

- Kelley Blue Book (KBB):A widely recognized source for used car values.

- National Automobile Dealers Association (NADA):Another reputable source for used car values.

- Auction data:Information from recent vehicle auctions.

Factors Influencing the Cost of Gap Insurance

The cost of State Farm Gap Insurance can vary depending on several factors, including:

- Vehicle type:The make, model, and year of your vehicle.

- Loan amount:The amount you owe on your loan or lease.

- Loan term:The length of your loan or lease.

- Credit score:Your credit history can influence the cost of insurance.

- Driving history:Your driving record, including accidents and violations.

Benefits of State Farm Gap Insurance: State Farm Gap Insurance Coverage

State Farm Gap Insurance offers several benefits, including:

Financial Protection

Gap Insurance provides financial protection by covering the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease. This can help you avoid a significant financial burden in the event of a total loss or theft.

Peace of Mind

Knowing that you have Gap Insurance can give you peace of mind, knowing that you won’t be left with a large debt if your vehicle is totaled or stolen. This can be especially important if you have a new or expensive vehicle.

Avoid Financial Burdens

Gap Insurance can help you avoid financial burdens by covering the gap amount, which can prevent you from having to pay out of pocket for the difference between the insurance payout and the loan balance.

Who Needs State Farm Gap Insurance?

Gap Insurance can be beneficial for a wide range of drivers, but it’s particularly advantageous for those who:

Types of Drivers Who Benefit Most

- Drivers with a new or nearly new vehicle:New vehicles depreciate quickly in value, so the actual cash value may be significantly lower than the loan amount.

- Drivers with a long loan term:A longer loan term can result in a higher loan balance, increasing the potential gap amount.

- Drivers with a high interest rate loan:A high interest rate can increase the total amount you owe on your loan, which can also increase the gap amount.

- Drivers with negative equity:If you owe more than your vehicle is worth, you have negative equity, and Gap Insurance can help cover the difference.

Situations Where Gap Insurance is Advantageous

- If you have a loan with a high loan-to-value ratio:This means you have a larger loan balance compared to the value of your vehicle.

- If you’re financing a luxury or high-performance vehicle:These vehicles tend to depreciate faster than other types of vehicles.

- If you’re leasing a vehicle:Leases often have a higher residual value than the actual cash value of the vehicle, which can create a larger gap.

Examples of Individuals Who Could Benefit

- A young driver who financed a new car with a long loan term.

- A family who purchased a used SUV with a high loan balance.

- An individual who leased a luxury car with a high residual value.

How to Obtain State Farm Gap Insurance

You can obtain State Farm Gap Insurance through your State Farm agent or online. Here’s how to get started:

Getting a Quote

To get a quote for Gap Insurance, you’ll need to provide your State Farm agent with some basic information about your vehicle, loan, and driving history. This information will help them calculate the cost of the coverage.

Purchasing Gap Insurance

Once you’ve received a quote, you can purchase Gap Insurance by paying the premium. The premium can be paid in installments or as a lump sum.

Adding Gap Insurance to an Existing Policy

You can also add Gap Insurance to an existing State Farm auto insurance policy. To do so, you’ll need to contact your State Farm agent and request a quote for the coverage.

State Farm Gap Insurance vs. Other Coverage

State Farm Gap Insurance is a separate type of coverage from other types of auto insurance, such as collision and comprehensive coverage. It’s important to understand the differences between these coverages to make sure you have the right protection for your vehicle.

Comparison with Collision Coverage

Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object. It’s not the same as Gap Insurance, which covers the difference between the actual cash value and the loan amount. If your vehicle is totaled in a collision, collision coverage will pay the actual cash value, but Gap Insurance will cover the remaining balance you owe on the loan.

Complementing Existing Policies

Gap Insurance can complement your existing auto insurance policies by providing additional financial protection in the event of a total loss or theft. It’s not a replacement for collision or comprehensive coverage, but it can help fill in the gaps in your coverage.

Considerations for State Farm Gap Insurance

While Gap Insurance can be a valuable asset, it’s important to consider the following:

Potential Limitations

- Gap Insurance may not cover all types of losses:For example, it may not cover losses caused by wear and tear, flood damage, or other non-covered events.

- There may be a deductible:You may have to pay a deductible before Gap Insurance will cover the remaining balance.

- Gap Insurance may have a time limit:The coverage may only apply for a certain period of time, such as the term of your loan or lease.

Situations Where Gap Insurance May Not Be Necessary

- If you have a short loan term:Your vehicle will have depreciated less in value, so the gap amount is likely to be smaller.

- If you have a low loan balance:The gap amount is likely to be smaller, and you may not need Gap Insurance.

- If you have a high credit score:You may be able to get a lower interest rate on your loan, which can reduce the total amount you owe.

Making an Informed Decision

To make an informed decision about Gap Insurance, it’s important to consider your individual circumstances, such as the age and value of your vehicle, the length of your loan term, and the amount you owe on your loan. You should also discuss your options with your State Farm agent to determine if Gap Insurance is right for you.

Wrap-Up

So, when it comes to protecting your investment, State Farm gap insurance can provide a crucial safety net. It’s like having a financial guardian angel watching over your car, ensuring you’re not left with a hefty debt if something unfortunate happens.

While it might seem like an extra expense, the peace of mind it offers is invaluable. Consider your driving habits, loan details, and the value of your vehicle to determine if gap insurance is the right fit for you.

State Farm gap insurance coverage is a lifesaver if you’re ever in an accident that totals your car. It covers the difference between what your car is worth and what you owe on your loan or lease. But, if you’re driving a luxury car, you’ll want to make sure you have a State Farm luxury car insurance policy that’s specifically designed to cover the unique needs of your vehicle.

This type of policy can include things like higher coverage limits, replacement parts, and specialized services. So, if you’re looking for comprehensive coverage for your luxury car, don’t forget to check out State Farm’s gap insurance options.

Common Queries

What happens if I already have collision coverage?

Collision coverage helps pay for repairs after an accident, but it doesn’t cover the difference between the actual cash value and the loan amount. Gap insurance fills that gap.

Can I get gap insurance even if I’ve had my car for a while?

Yes, you can! You can purchase gap insurance even if you’ve already owned your car for a while, as long as it’s still financed.

Is gap insurance mandatory?

No, it’s not mandatory. But it’s a smart decision for many drivers, especially those with high loan amounts or who want extra protection.