State Farm gap insurance policy for new cars can be a lifesaver for those who want to ensure they’re fully protected in the event of a total loss or theft. Imagine this: you’ve just bought a brand new car, gleaming and shiny, and then bam! An accident happens, leaving your car totaled.

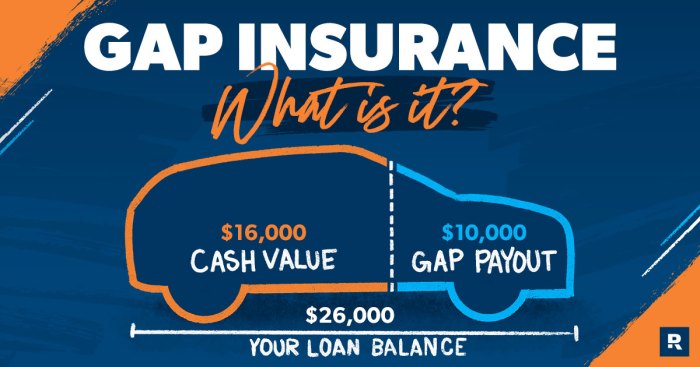

Your insurance pays out, but it’s only enough to cover the actual cash value, which is often significantly less than what you owe on your loan. That’s where gap insurance steps in, bridging the financial gap between your loan and the car’s actual value.

State Farm’s gap insurance policy is designed to help you avoid being stuck with a hefty debt after a major accident. It covers the difference between what your insurance pays out and the amount you still owe on your car loan.

So, you’re thinking about getting that shiny new car and want to make sure you’re covered, right? State Farm’s gap insurance policy can help bridge the gap between what you owe on your loan and what your insurance pays out if your car is totaled.

But what about if you’re in an accident and need a rental car? That’s where State Farm rental car reimbursement insurance comes in handy. With this coverage, you can drive a rental while your car is being repaired, giving you peace of mind knowing you’re still mobile.

And with State Farm’s gap insurance, you can rest easy knowing you’re protected from potential financial loss if your new car is a total loss.

This means you can walk away from the situation without being burdened by a large financial obligation.

Understanding State Farm Gap Insurance

If you’re a new car owner, you’re probably excited about your shiny new ride. But have you considered what happens if your car is totaled in an accident or stolen? Traditional car insurance only covers the actual cash value (ACV) of your car, which is its market value at the time of the loss.

This can be significantly less than what you owe on your car loan, leaving you with a hefty gap in your pocket. This is where State Farm’s gap insurance comes in.

State Farm gap insurance is a supplemental insurance policy designed to bridge the gap between the ACV of your vehicle and the outstanding loan balance. In simpler terms, it helps cover the difference between what your insurance pays out and what you still owe on your car loan.

State Farm’s gap insurance offers several key benefits for new car owners:

- Financial Protection:It protects you from potential financial losses if your car is totaled or stolen.

- Peace of Mind:Knowing you have gap insurance can provide peace of mind, knowing you won’t be stuck with a significant debt if your car is lost.

- Flexibility:You can choose to purchase gap insurance from State Farm if you have an existing car insurance policy with them or even if you don’t.

Coverage Details

State Farm’s gap insurance for new cars provides coverage in specific scenarios where your car is deemed a total loss or stolen. Here’s a breakdown of the scenarios where this insurance can be beneficial:

- Total Loss:If your car is damaged beyond repair in an accident, State Farm’s gap insurance will cover the difference between the ACV of your car and the outstanding loan balance.

- Theft:In case your car is stolen and not recovered, gap insurance will cover the remaining loan amount.

- Significant Damage:Even if your car is not declared a total loss, but the repair costs exceed a certain percentage of the ACV, gap insurance can cover the difference.

State Farm’s gap insurance typically covers most types of new vehicles, including cars, trucks, SUVs, and vans. However, specific exclusions may apply, so it’s crucial to review the policy details carefully.

Eligibility and Cost

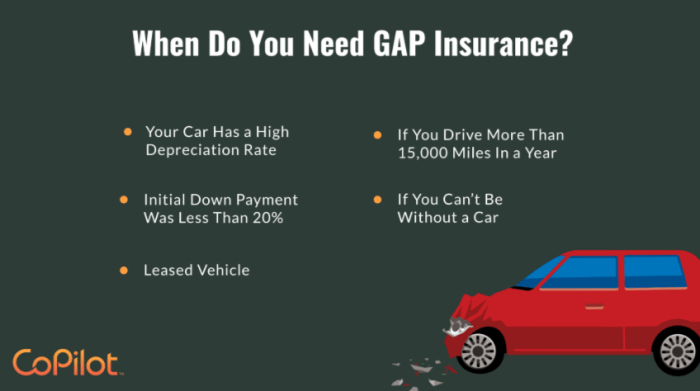

To be eligible for State Farm’s gap insurance, you typically need to meet certain criteria. These may include:

- Loan Amount:You must have a loan on your vehicle, and the loan amount must be higher than the ACV of the car.

- Vehicle Age:Gap insurance is generally offered for newer vehicles, typically within a specific age range.

- Existing Coverage:You may need to have a comprehensive and collision coverage on your car insurance policy.

The cost of State Farm’s gap insurance can vary depending on several factors:

- Vehicle Make and Model:The make and model of your car can influence the cost, as some vehicles have higher values than others.

- Age:The age of your vehicle also plays a role, as newer cars generally have a higher ACV.

- Loan Amount:The amount you owe on your car loan will also impact the cost of gap insurance.

It’s always advisable to compare the cost of State Farm’s gap insurance with other similar insurance products available in your area. This will help you make an informed decision based on your individual needs and budget.

Claim Process

Filing a claim with State Farm for gap insurance is generally straightforward. Here’s a step-by-step guide:

- Contact State Farm:Report the loss or theft of your vehicle to State Farm immediately. Provide all the necessary details, including the date, time, and location of the incident.

- Provide Documentation:You will need to provide supporting documentation, such as a police report (in case of theft), repair estimates, and loan documents. State Farm will guide you on the specific documents required.

- Claim Review:State Farm will review your claim and assess the ACV of your vehicle. They will also verify the outstanding loan amount.

- Claim Settlement:If your claim is approved, State Farm will issue a payment to cover the gap between the ACV and the loan balance. The settlement process may take some time, depending on the complexity of the claim.

It’s essential to keep all relevant documentation related to your car and loan in a safe place, as this will make the claim process smoother and faster.

Pros and Cons of State Farm Gap Insurance, State Farm gap insurance policy for new cars

Like any insurance policy, State Farm’s gap insurance has its advantages and disadvantages. Here’s a table comparing the pros and cons:

| Pros | Cons |

|---|---|

| Provides financial protection against potential losses | Additional cost on top of your regular car insurance |

| Offers peace of mind knowing you’re covered | May not be necessary if your car’s value depreciates quickly |

| Can help you avoid a financial burden | Limited coverage to specific scenarios like total loss or theft |

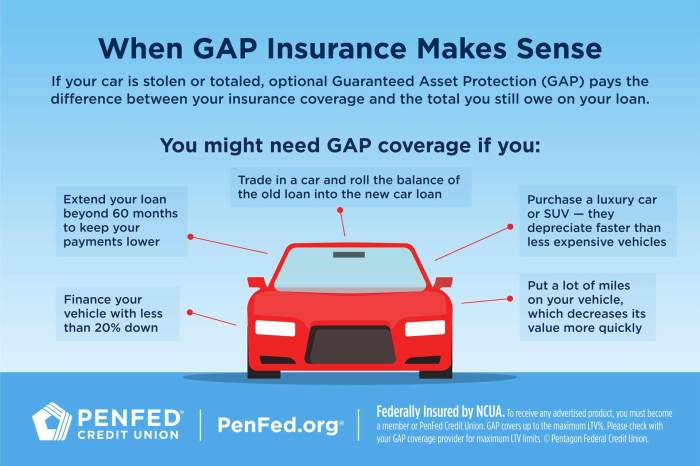

Gap insurance might be a suitable option for new car owners who have a significant loan balance and are concerned about potential financial losses. However, it’s important to consider the potential risks and limitations before making a decision.

Alternatives to State Farm Gap Insurance

If you’re looking for alternatives to State Farm’s gap insurance, there are other options available to help cover the gap between the ACV and your loan amount:

- Loan Protection Insurance:This type of insurance can cover your loan balance in case of death, disability, or unemployment. It’s not a direct replacement for gap insurance but can provide financial assistance in certain situations.

- Extended Warranty:While not specifically designed to cover the gap, an extended warranty can help protect you from unexpected repair costs for your vehicle. This can be beneficial if you’re concerned about the cost of repairs after the manufacturer’s warranty expires.

- Reduced Loan Amount:You could consider reducing your loan amount by making larger payments or refinancing your loan to a lower interest rate. This would reduce the gap between the ACV and the loan balance, minimizing your potential financial exposure.

Each of these alternatives has its own pros and cons, and it’s important to compare them carefully based on your individual circumstances and financial situation. Consulting with a financial advisor can help you make the best decision for your needs.

Final Conclusion

Navigating the world of car insurance can feel like driving through a maze, but with State Farm gap insurance for new cars, you can gain peace of mind knowing that your investment is protected. By understanding the coverage details, eligibility criteria, and cost factors, you can make an informed decision about whether gap insurance is right for you.

Remember, it’s always best to consult with a State Farm representative to get personalized advice and tailor your insurance needs to your specific situation.

FAQ Overview: State Farm Gap Insurance Policy For New Cars

Is State Farm gap insurance only for new cars?

While State Farm gap insurance is often recommended for new cars, it can also be beneficial for used vehicles, especially if you’ve taken out a loan with a significant amount remaining.

How long does State Farm gap insurance coverage last?

The duration of coverage depends on the specific policy terms and can vary depending on the age of your car and loan details. It’s best to check your policy documents or contact State Farm directly to determine the coverage period.

Can I cancel my State Farm gap insurance policy?

Yes, you can usually cancel your gap insurance policy. However, there may be cancellation fees or penalties depending on the terms of your policy. It’s important to review your policy documents or contact State Farm for specific cancellation details.