State Farm insurance coverage for foreign cars is a topic that often sparks questions for car owners who are new to the US or simply want to ensure their beloved import is protected. Whether you’re driving a classic European roadster or a modern Japanese performance machine, understanding how State Farm handles foreign vehicles is crucial.

This guide will explore the ins and outs of coverage, eligibility, and cost factors, giving you the information you need to make informed decisions about your insurance.

From the basics of liability, collision, and comprehensive coverage to the nuances of import documentation and potential cost differences, we’ll cover it all. We’ll also delve into the claims process, highlighting how State Farm assists foreign car owners, and explore the advantages and disadvantages of choosing State Farm compared to other insurance providers.

State Farm Insurance Coverage for Foreign Cars: Overview

Owning a foreign car in the United States can be an exciting experience, but it’s crucial to have the right insurance coverage to protect your investment. State Farm, one of the leading insurance providers in the country, offers a range of insurance options specifically tailored for foreign vehicles.

This article will delve into the intricacies of State Farm’s foreign car insurance coverage, providing you with a comprehensive understanding of its features, eligibility requirements, and benefits.

State Farm offers coverage for foreign cars, just like they do for domestic vehicles. Of course, rates can vary depending on the make and model, as well as the driver’s age and driving record. Speaking of drivers, if you’re looking for information on State Farm insurance for teenage drivers , you’ll find it on their website.

Back to foreign cars, it’s worth noting that State Farm can also help you with international coverage if you’re planning a trip abroad.

General Coverage Options

State Farm provides a comprehensive suite of insurance options for foreign cars, mirroring the coverage offered for domestic vehicles. These options include:

- Liability Coverage:This is the most basic type of insurance and is legally required in most states. It protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision Coverage:This coverage pays for repairs or replacement of your foreign car if it’s damaged in an accident, regardless of who is at fault. It’s typically recommended for newer or more expensive vehicles.

- Comprehensive Coverage:This coverage protects your foreign car from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage:This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured.

While these are the primary coverage options, State Farm may also offer additional coverage options tailored to foreign cars, such as:

- Rental Reimbursement:Covers the cost of a rental car while your foreign car is being repaired.

- Towing and Labor Coverage:Covers the cost of towing and roadside assistance if your foreign car breaks down.

- Gap Insurance:Covers the difference between the actual cash value of your foreign car and the outstanding loan balance if it’s totaled.

State Farm’s coverage for foreign cars is designed to provide comprehensive protection and peace of mind, ensuring that you’re covered in case of any unforeseen events.

Eligibility and Requirements

To be eligible for State Farm insurance for your foreign car, you’ll need to meet certain criteria and provide specific documentation. Here’s a breakdown:

- Vehicle Registration:You must have a valid registration for your foreign car in the state where you reside. This ensures that your vehicle is legally permitted to operate on public roads.

- Proof of Ownership:You’ll need to provide documentation that proves you are the legal owner of the foreign car, such as a title or bill of sale.

- Import Permits:If your foreign car was imported into the US, you’ll need to provide any relevant import permits or documentation. These documents verify that the vehicle meets US safety and emissions standards.

- Driving Record:State Farm will review your driving history to assess your risk profile. A clean driving record with no accidents or violations will generally lead to lower premiums.

Once you’ve met the eligibility criteria and provided the necessary documentation, you can obtain a quote for insurance. You can contact a State Farm agent directly, use their online quote tool, or get a quote through their mobile app.

Coverage Options and Benefits, State Farm insurance coverage for foreign cars

State Farm offers a range of coverage options for foreign cars, each with its unique benefits. Here’s a comparison:

- Liability Coverage:This is the minimum required coverage and provides financial protection if you cause an accident that results in injuries or property damage to others. The coverage limits will vary depending on your state’s requirements and your chosen coverage level.

- Collision Coverage:This coverage pays for repairs or replacement of your foreign car if it’s damaged in an accident, regardless of who is at fault. It’s especially valuable for newer or more expensive vehicles, as it helps cover the costs of repairs or replacement.

- Comprehensive Coverage:This coverage protects your foreign car from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s a good idea to consider this coverage, especially if your foreign car is a high-value model or if you live in an area prone to these events.

- Uninsured/Underinsured Motorist Coverage:This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It helps cover your medical expenses and vehicle damage in such situations.

Beyond these standard coverage options, State Farm may offer additional benefits, such as:

- Rental Reimbursement:Covers the cost of a rental car while your foreign car is being repaired, ensuring you have a means of transportation during the repair period.

- Towing and Labor Coverage:Covers the cost of towing and roadside assistance if your foreign car breaks down, providing peace of mind in case of unexpected breakdowns.

- Gap Insurance:Covers the difference between the actual cash value of your foreign car and the outstanding loan balance if it’s totaled, protecting you from potential financial losses.

Choosing the right coverage options depends on your individual needs and circumstances. A State Farm agent can help you assess your risk profile and recommend the most suitable coverage for your foreign car.

Cost Factors and Considerations

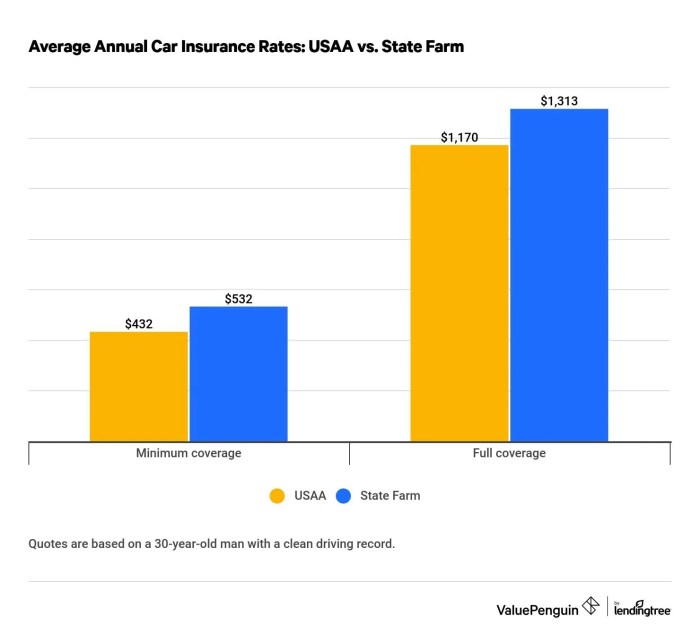

The cost of State Farm insurance for your foreign car will be influenced by various factors, including:

- Vehicle Age:Newer foreign cars generally have higher premiums due to their higher value and potential for greater repair costs.

- Make and Model:Certain foreign car makes and models are considered more expensive to repair or replace, leading to higher premiums.

- Import Status:Imported foreign cars may have higher premiums due to potential complexities in sourcing parts and specialized repair services.

- Driving Record:A clean driving record with no accidents or violations will generally lead to lower premiums.

- Location:Your location can impact premiums, as certain areas have higher rates of accidents or theft.

- Coverage Levels:The amount of coverage you choose, such as higher liability limits or comprehensive coverage, will affect your premium.

To reduce your insurance costs, consider exploring State Farm’s discounts, such as:

- Good Student Discount:Offered to students with good academic records.

- Safe Driver Discount:Awarded to drivers with a clean driving record.

- Multi-Car Discount:Available if you insure multiple vehicles with State Farm.

- Anti-theft Device Discount:Offered if your foreign car has an anti-theft device installed.

By understanding these cost factors and taking advantage of available discounts, you can potentially lower your insurance premiums for your foreign car.

End of Discussion: State Farm Insurance Coverage For Foreign Cars

Navigating the world of insurance for your foreign car can seem complex, but with the right information, it can be a straightforward process. By understanding the coverage options, eligibility requirements, and potential cost factors, you can make an informed decision that provides peace of mind and financial protection.

Remember, State Farm is a reliable partner for insuring your foreign car, offering comprehensive coverage and support tailored to your specific needs. So, don’t hesitate to reach out to them with any questions you may have.

FAQ Overview

What types of foreign cars does State Farm insure?

State Farm insures a wide range of foreign car makes and models, from popular European brands like BMW and Mercedes-Benz to Japanese manufacturers like Toyota and Honda, and even exotic cars.

Does State Farm offer roadside assistance for foreign cars?

Yes, State Farm offers roadside assistance for foreign cars, just like they do for domestic vehicles. This includes services like towing, jump starts, and tire changes.

Are there any language barriers when filing a claim for a foreign car?

State Farm has a network of multilingual representatives who can assist you with your claim, regardless of your native language.

Can I get a discount on my insurance if I have a foreign car with safety features?

Yes, State Farm often offers discounts for vehicles with safety features like anti-lock brakes, airbags, and stability control, even for foreign cars.