State Farm insurance deductible calculator online is your secret weapon for navigating the often confusing world of insurance premiums and deductibles. Imagine this: you’re shopping for a new car insurance policy, but you’re unsure how a higher deductible will impact your monthly payments.

This handy online tool takes the guesswork out of the equation, allowing you to explore different scenarios and make informed decisions about your coverage.

The State Farm deductible calculator is a user-friendly tool that allows you to quickly and easily estimate your insurance premiums based on your chosen deductible amount. It covers a wide range of insurance policies, including auto, home, and renters insurance, giving you a comprehensive picture of your financial obligations.

State Farm Insurance Deductible Calculator Overview

The State Farm insurance deductible calculator is a valuable tool that helps you understand how deductibles affect your insurance premiums and out-of-pocket expenses. By using this online calculator, you can explore different deductible options and see how they impact your overall insurance costs.

Purpose of the Calculator

The State Farm deductible calculator serves a crucial purpose: to empower you with knowledge and control over your insurance costs. It allows you to:

- Calculate the potential impact of different deductibles on your premiums.

- Compare the cost of various deductible options for your specific insurance needs.

- Make informed decisions about your deductible choices based on your risk tolerance and financial situation.

Using the Online Calculator

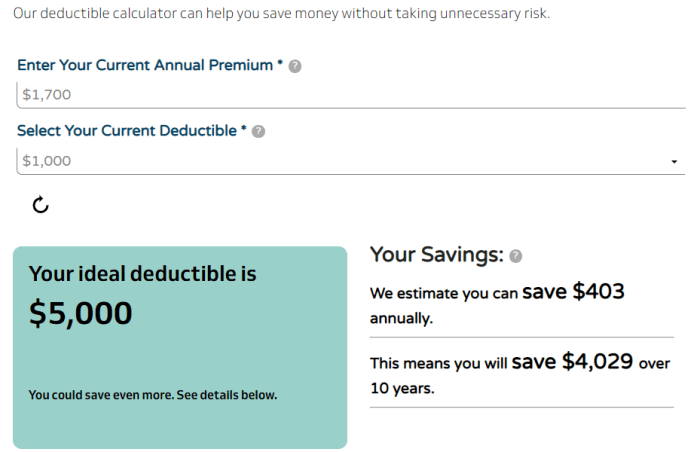

Navigating the State Farm insurance deductible calculator is straightforward. Follow these simple steps:

- Visit the State Farm website and locate the insurance deductible calculator. It’s typically accessible through their online services or customer portal.

- Select the type of insurance you want to explore, such as auto, home, or renters insurance.

- Enter the required information, including your coverage details, vehicle information (for auto insurance), or property details (for home or renters insurance).

- Choose different deductible amounts to see how they affect your premium estimates.

- Review the calculator’s results, which will show you the estimated premium for each deductible option.

Types of Insurance Policies Covered

The State Farm insurance deductible calculator covers a range of common insurance policies, including:

- Auto Insurance: This covers your vehicle against damage or loss in accidents, theft, or natural disasters.

- Home Insurance: This protects your home and belongings against various risks, such as fire, theft, and natural disasters.

- Renters Insurance: This provides coverage for your personal belongings and liability in case of damage or loss in a rental property.

Factors Influencing Deductibles

Several factors play a role in determining your insurance deductible, and understanding these factors is essential for making informed decisions about your coverage.

Key Factors

The following factors significantly influence your insurance deductible:

- Type of Insurance: Different insurance policies have varying deductible options. For example, auto insurance deductibles might differ from home insurance deductibles.

- Coverage Limits: The amount of coverage you choose for your insurance policy can impact your deductible. Higher coverage limits may result in higher deductibles.

- Risk Profile: Your individual risk profile, such as your driving history (for auto insurance) or the age and condition of your home (for home insurance), can influence your deductible.

- Location: Your geographical location can affect deductibles due to factors like crime rates, natural disaster risks, and local regulations.

Impact on Premiums

The relationship between deductibles and premiums is inverse: a higher deductible generally results in a lower premium, and vice versa. This is because a higher deductible means you agree to pay more out-of-pocket in case of a claim, which reduces the insurance company’s risk and allows them to offer a lower premium.

Out-of-Pocket Expenses

The deductible you choose directly affects your out-of-pocket expenses in case of a claim. A higher deductible means you’ll pay more upfront when you file a claim, but your premium will be lower. Conversely, a lower deductible means you’ll pay less out-of-pocket for a claim, but your premium will be higher.

Understanding Deductible Options

State Farm offers a range of deductible options for its insurance policies, allowing you to customize your coverage based on your individual needs and financial situation.

Deductible Choices

Here’s a breakdown of the common deductible options available for State Farm policies:

- Low Deductibles: These offer lower out-of-pocket expenses in case of a claim but typically come with higher premiums.

- High Deductibles: These require you to pay more out-of-pocket for a claim but result in lower premiums. This option is often preferred by individuals with a lower risk tolerance and a stronger financial cushion.

- Variable Deductibles: Some insurance policies allow for variable deductibles, where you can choose a different deductible amount for different types of claims or situations.

Pros and Cons

Choosing a higher or lower deductible involves a trade-off between premium costs and out-of-pocket expenses. Here’s a summary of the pros and cons of each option:

| Deductible Option | Pros | Cons |

|---|---|---|

| Higher Deductible | Lower Premiums | Higher Out-of-Pocket Expenses |

| Lower Deductible | Lower Out-of-Pocket Expenses | Higher Premiums |

Real-World Examples

Imagine two drivers, both with State Farm auto insurance, who are involved in accidents. Driver A has a $500 deductible, while Driver B has a $1000 deductible. Both drivers have the same coverage limits. If both drivers incur $2000 in damages, Driver A will pay $500 out-of-pocket, and State Farm will cover the remaining $1500.

Driver B will pay $1000 out-of-pocket, and State Farm will cover the remaining $1000. While Driver A has a higher premium, they pay less out-of-pocket for the claim. Driver B has a lower premium but faces a higher out-of-pocket expense.

Deductible Calculator Benefits

The State Farm insurance deductible calculator offers numerous benefits, making it a valuable tool for customers seeking to understand and manage their insurance costs.

Benefits of Using the Calculator

Here are some key advantages of using the State Farm deductible calculator:

- Personalized Estimates: The calculator provides personalized premium estimates based on your specific insurance needs and coverage details.

- Informed Decision-Making: By exploring different deductible options and their impact on premiums, you can make informed decisions that align with your financial situation and risk tolerance.

- Cost Comparison: The calculator allows you to compare the cost of various deductible options, helping you identify the most cost-effective choice for your circumstances.

- Transparency and Control: The calculator provides transparency into how deductibles affect your insurance costs, empowering you with greater control over your insurance expenses.

Examples of Informed Decisions, State Farm insurance deductible calculator online

Consider a homeowner who is using the State Farm deductible calculator for their home insurance. By exploring different deductible options, they discover that increasing their deductible from $500 to $1000 would save them $100 per year on their premium. They determine that they are comfortable with a higher deductible, knowing that they have a financial cushion to cover the increased out-of-pocket expense in case of a claim.

This informed decision allows them to save on their insurance premiums without compromising their coverage.

Deductible Calculator Limitations

While the State Farm deductible calculator is a valuable tool, it’s essential to be aware of its limitations to avoid relying solely on its results for critical decisions.

Want to know how much your State Farm insurance deductible will be? Use their online calculator to get a personalized estimate. But remember, if you’re insuring a luxury vehicle, you might want to check out State Farm insurance coverage for luxury vehicles to make sure you’re getting the right protection for your prized possession.

After all, that deductible calculator won’t do you much good if your coverage isn’t sufficient for your specific needs!

Limitations of the Calculator

Here are some potential limitations of the State Farm deductible calculator:

- Simplified Estimates: The calculator provides estimated premiums based on general factors and may not account for all individual circumstances, such as specific discounts or risk factors.

- Limited Coverage Options: The calculator may not include all available coverage options or deductible amounts offered by State Farm.

- No Personal Advice: The calculator cannot provide personalized financial or insurance advice. It’s crucial to consult with a State Farm agent or insurance professional for tailored guidance.

Addressing Limitations

To address these limitations, it’s recommended to:

- Consult with a State Farm Agent: Discuss your insurance needs and coverage options with a knowledgeable State Farm agent, who can provide personalized advice and help you explore all available options.

- Review Policy Documents: Carefully review your State Farm insurance policy documents to understand the specific coverage details, deductible options, and any limitations that apply to your policy.

- Seek Professional Advice: If you have complex insurance needs or are unsure about your deductible choices, consider consulting with an independent insurance broker or financial advisor.

Final Conclusion: State Farm Insurance Deductible Calculator Online

By understanding how deductibles work and utilizing the State Farm insurance deductible calculator online, you can find the perfect balance between affordability and peace of mind. Remember, a higher deductible usually means lower premiums, but it also means you’ll pay more out of pocket if you need to file a claim.

The calculator empowers you to weigh these factors and make a choice that aligns with your individual needs and budget.

FAQ Corner

What happens if I choose a higher deductible?

Generally, a higher deductible means lower monthly premiums. You’ll pay less each month, but you’ll also pay more out of pocket if you need to file a claim.

Can I use the calculator for different types of insurance?

Yes! The State Farm deductible calculator covers auto, home, and renters insurance, giving you a comprehensive view of your options.

How accurate are the results from the calculator?

The calculator provides estimates based on your input. For a precise quote, you’ll need to contact a State Farm agent.

What if I have a complex insurance situation?

For complex scenarios, it’s best to speak with a State Farm agent. They can help you tailor your policy to your unique needs.