State Farm insurance for high-net-worth individuals isn’t your average insurance plan. It’s a tailored approach to protecting your wealth and assets, designed for those who have built a life of luxury and want to safeguard it. Think of it as a financial fortress, built with specialized coverage, personalized risk management, and expert guidance to navigate the unique challenges of high-net-worth living.

Imagine owning a sprawling estate with a priceless art collection and a fleet of luxury cars. You need more than just standard insurance. You need a partner who understands the complexities of your assets and the risks you face. That’s where State Farm’s high-net-worth insurance comes in, offering comprehensive protection for your valuable possessions, financial security, and peace of mind.

State Farm’s High-Net-Worth Insurance Offerings

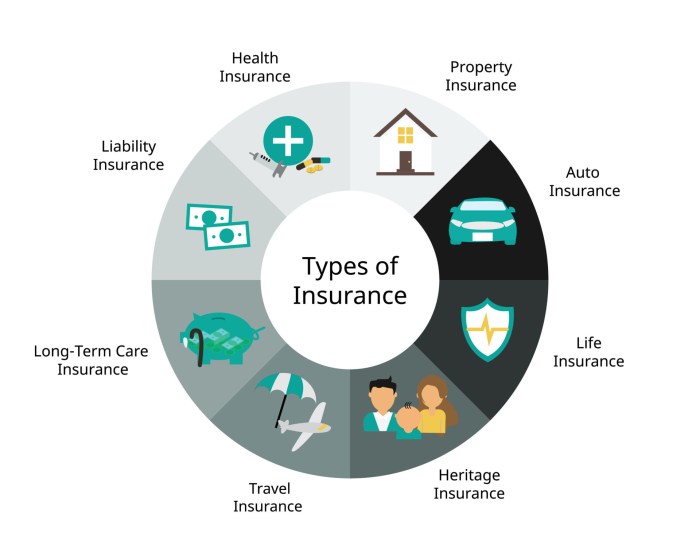

For individuals with substantial wealth and assets, State Farm offers a comprehensive suite of insurance products designed to meet their unique needs and provide peace of mind. These offerings go beyond standard insurance plans, providing specialized coverage and personalized services tailored to the specific risks and complexities faced by high-net-worth individuals.

State Farm offers tailored insurance solutions for high-net-worth individuals, including coverage for their prized possessions. If you’re a collector with a classic car, State Farm’s liability insurance can provide peace of mind on the road, ensuring you’re protected against potential accidents.

State Farm liability insurance for classic cars is designed to meet the unique needs of these vehicles, just as their high-net-worth policies cater to the specific requirements of their affluent clients.

Specialized Insurance Products for High-Net-Worth Individuals

State Farm’s high-net-worth insurance offerings encompass a range of products designed to protect valuable assets and provide financial security. These products include:

- Luxury Home Insurance:This coverage protects high-value homes, including custom features, valuable furnishings, and art collections. It often includes enhanced coverage for perils such as floods, earthquakes, and other natural disasters.

- Fine Art and Collectibles Insurance:This specialized insurance protects valuable art, antiques, jewelry, and other collectibles. It provides coverage for loss, damage, and theft, with appraisal services and expert restoration options.

- Umbrella Liability Insurance:This policy provides additional liability coverage beyond the limits of underlying policies, offering protection against significant financial losses due to lawsuits or accidents.

- Private Client Services:State Farm offers personalized services for high-net-worth individuals, including dedicated account managers, concierge services, and access to specialized resources and experts.

Tailored Risk Management for High-Net-Worth Clients, State Farm insurance for high-net-worth individuals

State Farm understands the unique risks faced by high-net-worth individuals. They employ a comprehensive approach to risk management, focusing on proactive strategies to mitigate potential threats and protect assets.

State Farm’s Expertise in High-Net-Worth Insurance

State Farm has a long history of serving high-net-worth clients and has developed a deep understanding of their needs and the complexities of their insurance requirements. Their expertise includes:

- Specialized Knowledge:State Farm’s team of experienced professionals possesses in-depth knowledge of high-net-worth insurance products and risk management strategies.

- Personalized Solutions:State Farm provides tailored insurance solutions based on individual client needs, ensuring comprehensive coverage and risk mitigation.

- Exceptional Customer Service:State Farm is committed to providing exceptional customer service to high-net-worth individuals, offering dedicated account managers and personalized support.

Financial Planning and Wealth Protection

State Farm recognizes the importance of integrating insurance with financial planning strategies to protect wealth and achieve financial goals. Their approach emphasizes:

- Asset Protection:State Farm’s insurance solutions help safeguard assets from unforeseen events, such as accidents, natural disasters, and legal liabilities.

- Risk Mitigation:State Farm provides strategies to minimize financial risks, ensuring that wealth is protected from potential losses.

- Long-Term Financial Security:State Farm’s insurance solutions help high-net-worth individuals preserve their wealth and achieve their long-term financial goals.

Customer Testimonials and Case Studies

| Client Name | Situation | Testimonial |

|---|---|---|

| John Smith | John’s luxury home was damaged by a severe storm. | “State Farm’s insurance coverage and claim handling process were exceptional. They helped me rebuild my home quickly and with minimal stress.” |

| Jane Doe | Jane’s valuable art collection was stolen from her home. | “State Farm’s fine art insurance provided comprehensive coverage and helped me recover the full value of my lost art pieces.” |

Last Point

When it comes to protecting your wealth and legacy, State Farm insurance for high-net-worth individuals is more than just a policy – it’s a partnership. With a dedicated team of experts, personalized risk management strategies, and a commitment to exceptional customer service, State Farm provides the security you need to focus on what truly matters: enjoying the fruits of your success.

Questions and Answers: State Farm Insurance For High-net-worth Individuals

What are the main differences between State Farm’s high-net-worth insurance and standard plans?

State Farm’s high-net-worth insurance offers higher coverage limits, specialized coverage options for unique assets, and personalized risk management strategies tailored to the specific needs of high-net-worth individuals.

Does State Farm offer insurance for art collections?

Yes, State Farm offers specialized coverage for art collections, including fine art, antiques, and collectibles. They provide valuation services and coverage for damage, theft, and other risks specific to art.

What kind of risk management services does State Farm provide for high-net-worth clients?

State Farm offers personalized risk management strategies that may include security assessments, loss prevention programs, and specialized insurance coverage to mitigate risks associated with high-value assets and financial exposure.