State Farm rental car coverage policy offers a safety net for drivers who want to be protected while cruising in a rental car. It’s like having a trusty sidekick ensuring you’re covered for unexpected bumps in the road, whether it’s a fender bender or a flat tire.

This policy is designed to provide financial security and ease your mind, allowing you to focus on enjoying your journey.

So you’re planning a road trip and want to know about State Farm’s rental car coverage policy? It’s a good thing to consider, especially if you’re a little accident-prone. But don’t worry, State Farm’s got you covered with their State Farm accident forgiveness insurance , which can help keep your rates from skyrocketing after a fender bender.

This way, you can focus on enjoying your trip and not stress about the financial fallout of a minor mishap. Just remember to check the details of your rental car coverage with State Farm to ensure you’re fully protected on the road.

From understanding eligibility requirements and coverage details to navigating the claim process, this comprehensive guide will equip you with the knowledge to make informed decisions about your rental car coverage. We’ll also delve into the cost and premiums associated with this policy, comparing it to other insurance providers.

Let’s break down the details and unlock the benefits of State Farm’s rental car coverage!

State Farm Rental Car Coverage Policy Overview

When you’re on the road, peace of mind is essential. That’s where State Farm’s rental car coverage comes in. This policy is designed to provide financial protection and coverage for unexpected situations while driving a rental car. Whether you’re on a business trip, a family vacation, or simply need a temporary vehicle, State Farm’s rental car coverage can help alleviate the stress of potential accidents or damages.

Purpose of State Farm’s Rental Car Coverage, State Farm rental car coverage policy

State Farm’s rental car coverage acts as an extension of your existing auto insurance policy, offering protection for your rental vehicle. It helps cover expenses related to accidents, theft, or damage to the rental car, giving you peace of mind knowing that you’re financially protected.

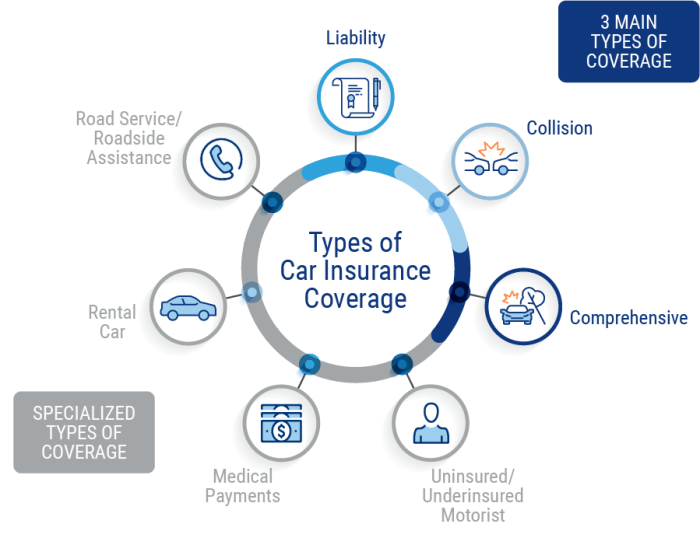

Types of Rental Car Coverage

State Farm offers several types of rental car coverage to cater to different needs and budgets. These options include:

- Liability Coverage:This coverage protects you against financial liability for injuries or property damage caused to others in an accident while driving a rental car.

- Collision Coverage:This coverage helps pay for repairs or replacement of the rental car if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage:This coverage protects the rental car against damage caused by non-collision events, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP):This coverage provides medical benefits for you and your passengers if you’re injured in an accident while driving a rental car.

Key Benefits of State Farm Rental Car Coverage

Having rental car coverage through State Farm offers numerous benefits, including:

- Financial Protection:Coverage helps protect you from significant financial losses in case of an accident or damage to the rental car.

- Peace of Mind:Knowing you have coverage can alleviate stress and worry while driving a rental car.

- Convenience:Filing a claim with State Farm is generally straightforward and convenient.

- Potential Savings:Rental car coverage can help you avoid paying for expensive repairs or replacement costs out of pocket.

Eligibility and Requirements

To be eligible for State Farm’s rental car coverage, you must meet certain criteria. These criteria are designed to ensure that the coverage is available to responsible drivers and that the coverage is used appropriately.

Eligibility Criteria

To be eligible for State Farm’s rental car coverage, you must generally meet the following criteria:

- Have a valid driver’s license:You must have a valid driver’s license in the state where you are renting the car.

- Be at least 18 years old:Most rental car companies require drivers to be at least 18 years old, and this requirement may also apply to State Farm’s rental car coverage.

- Have a valid State Farm auto insurance policy:You must have an active State Farm auto insurance policy to qualify for rental car coverage.

- Meet the rental car company’s requirements:You must also meet the specific requirements of the rental car company, such as having a credit card or a valid form of identification.

Requirements for Accessing Rental Car Coverage

To access State Farm’s rental car coverage, you will typically need to:

- Inform State Farm about the rental:Before renting a car, you should contact State Farm and inform them about the rental. This allows them to add rental car coverage to your existing policy.

- Provide rental car details:When you contact State Farm, you will need to provide them with details about the rental, such as the rental company, dates of the rental, and the type of vehicle you are renting.

- Pay any applicable premiums:Depending on your coverage options, you may need to pay additional premiums for rental car coverage.

Limitations and Exclusions

State Farm’s rental car coverage may have limitations or exclusions that apply. These limitations are important to understand as they can affect your coverage in certain situations. Some common limitations or exclusions may include:

- Coverage limits:The amount of coverage provided under State Farm’s rental car policy may have limits. For example, there may be a maximum amount that State Farm will pay for repairs or replacement of the rental car.

- Deductibles:You may be required to pay a deductible before State Farm begins to cover expenses. The deductible amount will vary depending on your coverage options.

- Exclusions:State Farm’s rental car coverage may not cover certain situations, such as accidents caused by driving under the influence of alcohol or drugs, or damage caused by intentional acts.

Coverage Details

State Farm’s rental car coverage policy includes several types of coverage that provide financial protection for different situations. Understanding the specific coverage details can help you make informed decisions about your rental car insurance needs.

Types of Coverage

State Farm’s rental car coverage typically includes the following types of coverage:

- Liability Coverage:This coverage protects you against financial liability for injuries or property damage caused to others in an accident while driving a rental car.

- Collision Coverage:This coverage helps pay for repairs or replacement of the rental car if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage:This coverage protects the rental car against damage caused by non-collision events, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP):This coverage provides medical benefits for you and your passengers if you’re injured in an accident while driving a rental car.

Coverage Limits and Deductibles

The coverage limits and deductibles associated with State Farm’s rental car coverage can vary depending on your specific policy and the coverage options you choose. It’s important to review your policy carefully to understand these details.

| Coverage Type | Coverage Limit | Deductible |

|---|---|---|

| Liability Coverage | Varies depending on state law and policy | Not applicable |

| Collision Coverage | Actual cash value of the rental car | Varies depending on policy |

| Comprehensive Coverage | Actual cash value of the rental car | Varies depending on policy |

| Personal Injury Protection (PIP) | Varies depending on state law and policy | Not applicable |

Comparison of Coverage Options

State Farm offers various coverage options for rental car insurance. Understanding the differences between these options can help you choose the coverage that best suits your needs and budget.

| Coverage Option | Benefits |

|---|---|

| Basic Coverage | Provides liability coverage only |

| Standard Coverage | Includes liability, collision, and comprehensive coverage |

| Premium Coverage | Includes all standard coverage options plus additional benefits, such as rental car reimbursement and roadside assistance |

Claim Process

If you need to file a claim for rental car coverage under State Farm, it’s important to understand the process and the necessary documentation. Following the proper steps can help ensure a smooth and efficient claim process.

Steps Involved in Filing a Claim

To file a claim for rental car coverage under State Farm, you will typically need to follow these steps:

- Contact State Farm:As soon as possible after an accident or damage to the rental car, contact State Farm to report the incident.

- Provide claim details:When you contact State Farm, you will need to provide them with details about the incident, including the date, time, location, and any witnesses.

- Gather documentation:You will need to gather documentation to support your claim, such as a police report, rental agreement, and photos of the damage.

- Submit claim documents:Once you have gathered all the necessary documentation, submit it to State Farm.

- Review claim status:State Farm will review your claim and contact you with an update on the status.

Necessary Documentation

The specific documentation required for a rental car claim may vary depending on the circumstances of the incident. However, some common documents that you may need to provide include:

- Police report:If the incident involved an accident, you will need to obtain a police report.

- Rental agreement:You will need to provide a copy of the rental agreement for the vehicle.

- Photos of the damage:Take clear photos of the damage to the rental car, both inside and outside.

- Witness statements:If there were any witnesses to the incident, obtain their contact information and statements.

- Medical records:If you or your passengers were injured, you will need to provide medical records.

Tips for Maximizing Claim Success

To maximize your chances of a successful claim, consider the following tips:

- Report the incident promptly:Contact State Farm as soon as possible after the incident to avoid any delays in processing your claim.

- Gather all necessary documentation:Ensure you have all the required documentation to support your claim before submitting it.

- Be honest and accurate:Provide accurate information about the incident to avoid any potential complications.

- Cooperate with State Farm:Respond to any requests for information or documentation promptly and cooperate with State Farm’s investigation.

Cost and Premiums

The cost of State Farm’s rental car coverage varies depending on several factors. Understanding these factors can help you estimate the cost and compare it to other insurance providers.

Cost of Rental Car Coverage

The cost of State Farm’s rental car coverage can vary depending on factors such as:

- Your existing auto insurance policy:Your current auto insurance policy, including your coverage limits and deductibles, can influence the cost of rental car coverage.

- Your driving history:Your driving history, including any accidents or violations, can affect the premium amount.

- The type of rental car:The type of rental car you choose, such as the make, model, and year, can also impact the cost of coverage.

- The length of the rental:The duration of the rental can influence the premium amount. Longer rentals may have higher premiums.

- Your location:Your location can also play a role in the cost of rental car coverage, as insurance rates can vary depending on the region.

Factors Influencing Premium Amount

Several factors can influence the premium amount for State Farm’s rental car coverage. These factors include:

- Coverage options:The coverage options you choose, such as liability, collision, and comprehensive coverage, can affect the premium amount.

- Deductible:A higher deductible typically results in a lower premium, while a lower deductible may lead to a higher premium.

- Driving history:Your driving history, including any accidents or violations, can influence the premium amount.

- Age and gender:Your age and gender can also play a role in determining the premium amount.

- Vehicle type:The type of rental car you choose, such as the make, model, and year, can impact the premium amount.

Comparison to Other Insurance Providers

It’s important to compare the cost of State Farm’s rental car coverage to other insurance providers to ensure you’re getting the best value for your money. Consider factors such as the coverage options, deductibles, and customer service when comparing providers.

Additional Considerations

When considering State Farm’s rental car coverage, it’s essential to understand the terms and conditions of the policy and make informed decisions about your coverage needs.

Understanding Terms and Conditions

Before purchasing rental car coverage from State Farm, carefully review the policy’s terms and conditions. Pay attention to details such as coverage limits, deductibles, exclusions, and claim procedures. Understanding these details can help you avoid any surprises or disputes later on.

Potential Scenarios for Rental Car Coverage

Rental car coverage can be beneficial in various scenarios, including:

- Accidents:If you’re involved in an accident while driving a rental car, coverage can help protect you from financial liability for damages.

- Theft:If the rental car is stolen, coverage can help replace the vehicle or reimburse you for the loss.

- Damage:If the rental car is damaged due to a non-collision event, such as vandalism or a natural disaster, coverage can help pay for repairs or replacement.

- Injuries:If you or your passengers are injured in an accident, coverage can provide medical benefits.

Making Informed Decisions

When making decisions about rental car coverage, consider factors such as your budget, your driving history, the type of rental car you’re planning to rent, and the length of the rental. It’s also essential to compare coverage options and prices from different insurance providers to find the best value for your needs.

Closing Notes

Whether you’re a frequent traveler or a casual renter, having the right rental car coverage can be a game-changer. State Farm’s policy provides peace of mind, knowing that you’re financially protected in the event of an accident or damage.

By understanding the intricacies of this policy, you can make informed choices that align with your needs and ensure a smooth and worry-free rental experience.

Query Resolution

What are the common types of coverage offered by State Farm’s rental car policy?

State Farm typically offers coverage for collision damage, theft, and liability. This means they’ll help cover repairs or replacement costs if your rental car is damaged or stolen, and they’ll provide legal protection if you’re found liable for an accident.

How much does State Farm’s rental car coverage cost?

The cost of State Farm’s rental car coverage varies depending on factors like the type of vehicle you’re renting, the length of your rental, and your driving history. It’s best to contact State Farm directly for a personalized quote.

Can I use my personal auto insurance to cover my rental car?

While your personal auto insurance may offer some coverage for rental cars, it’s essential to check your policy details. Some policies may have limitations or exclusions, so it’s always best to confirm with your insurance provider.

What happens if I have an accident while driving a rental car?

If you’re involved in an accident, it’s crucial to report it to the rental car company and your insurance provider. Follow the steps Artikeld in your rental agreement and your insurance policy for filing a claim.