State Farm premium coverage for new cars offers a range of options to safeguard your investment. Whether you’re a seasoned driver or just starting out, understanding the nuances of coverage is crucial. From collision and comprehensive protection to optional add-ons like roadside assistance, State Farm provides a comprehensive approach to car insurance.

But how do you navigate the different options and ensure you’re getting the right coverage at the right price?

This guide dives deep into State Farm’s new car insurance offerings, exploring the factors that influence premium costs, comparing them to competitors, and outlining the process of getting a quote and filing a claim. Buckle up, because we’re about to unlock the secrets of State Farm’s new car coverage.

State Farm New Car Coverage Overview: State Farm Premium Coverage For New Cars

Owning a new car is an exciting experience, but it’s also crucial to protect your investment with comprehensive insurance. State Farm, a leading insurance provider, offers a range of coverage options tailored to meet the needs of new car owners.

This article will delve into the key features of State Farm’s new car coverage, explore factors that influence premium costs, compare State Farm with competitors, and guide you through the process of getting a quote and filing a claim.

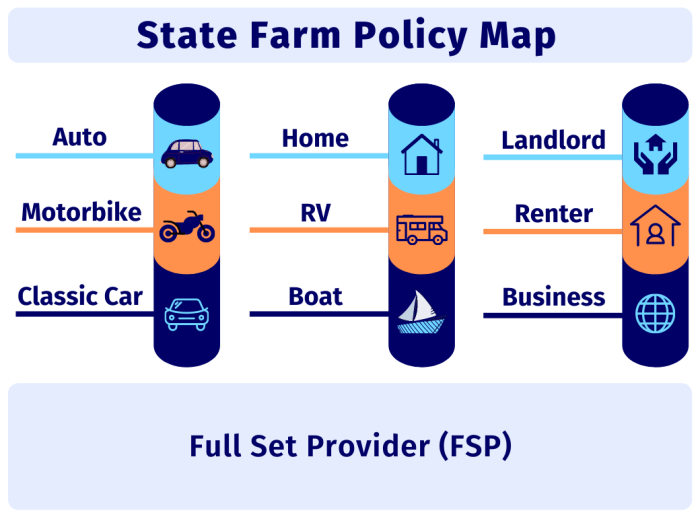

State Farm New Car Coverage Options, State Farm premium coverage for new cars

State Farm provides a comprehensive suite of coverage options to protect your new car, ensuring peace of mind on the road. Here’s a breakdown of the key types of coverage:

- Collision Coverage:This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage:This coverage protects your car against damages caused by non-collision events, such as theft, vandalism, fire, or natural disasters.

- Liability Coverage:This coverage is required by law in most states and protects you financially if you cause an accident that injures someone or damages their property.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP):This coverage, available in some states, helps pay for medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of fault.

In addition to these core coverage options, State Farm offers several optional add-ons to enhance your protection:

- Roadside Assistance:This coverage provides help with situations like flat tires, jump starts, towing, and lockout services.

- Rental Car Reimbursement:This coverage helps cover the cost of a rental car if your vehicle is being repaired due to an accident or covered event.

- Gap Insurance:This coverage pays the difference between the actual cash value of your car and the outstanding loan balance if your car is totaled.

Factors Influencing State Farm Premium Costs

The cost of your State Farm new car insurance premium is influenced by a variety of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

State Farm offers a range of premium coverage options for your shiny new car, but how much will it cost? Don’t worry, you can easily find out with the State Farm auto insurance premium calculator. Just plug in your details and see what kind of coverage fits your budget and your brand-new set of wheels.

- Vehicle Make, Model, and Year:The type of car you drive significantly impacts your premium. Luxury cars, high-performance vehicles, and newer models tend to have higher premiums due to their higher repair costs and greater risk of theft.

- Location:Where you live can also affect your premium. Areas with higher rates of accidents, theft, or vandalism typically have higher insurance costs.

- Driver History:Your driving record plays a crucial role in determining your premium. A clean driving record with no accidents or violations will generally result in lower premiums. Factors like age and experience also come into play, with younger drivers typically facing higher rates.

- Credit Score:In some states, insurance companies may use your credit score as a factor in calculating your premium. This is because studies have shown a correlation between credit score and driving behavior.

- Safety Features:Cars equipped with advanced safety features like anti-lock brakes, electronic stability control, and airbags can lead to lower premiums, as these features reduce the risk of accidents and injuries.

- Driver Assistance Technology:Features like adaptive cruise control, lane departure warning, and automatic emergency braking can also contribute to lower premiums by improving driver safety and reducing the likelihood of accidents.

Comparing State Farm with Competitors

When choosing an insurance provider, it’s essential to compare quotes and coverage options from different companies. Here’s a comparison of State Farm’s new car coverage with similar offerings from other major insurance providers:

| Insurance Company | Collision Coverage | Comprehensive Coverage | Liability Coverage | Customer Satisfaction |

|---|---|---|---|---|

| State Farm | Yes | Yes | Yes | High |

| Geico | Yes | Yes | Yes | High |

| Progressive | Yes | Yes | Yes | High |

| Allstate | Yes | Yes | Yes | High |

This table provides a general overview, and actual premiums and coverage options may vary depending on your individual circumstances. It’s always recommended to get personalized quotes from multiple insurance companies to find the best coverage at the most competitive price.

Getting a Quote and Policy Details

Getting a quote for State Farm’s new car insurance is a straightforward process. You can obtain a quote online, over the phone, or through a local State Farm agent.

- Gather Your Information:To get an accurate quote, you’ll need to provide information about your vehicle, including the make, model, year, and VIN. You’ll also need to provide your driving history, address, and contact information.

- Choose Your Coverage Options:State Farm offers a variety of coverage options, and you can select the ones that best meet your needs and budget. Consider factors like your driving habits, the value of your car, and your financial situation.

- Get a Quote:Once you’ve provided the necessary information and selected your coverage options, State Farm will generate a personalized quote. This quote will Artikel the premium costs and coverage details.

- Review and Purchase:Carefully review the quote to ensure it meets your requirements. If you’re satisfied, you can purchase the policy online, over the phone, or through a local agent.

Filing a Claim and Customer Support

In the unfortunate event of an accident or damage to your new car, State Farm makes the claim filing process as convenient as possible. You can file a claim online, over the phone, or through the State Farm mobile app.

- Online:State Farm’s website offers a user-friendly online claim filing portal where you can submit details about the accident or damage.

- Phone:You can also file a claim by calling State Farm’s 24/7 customer service line.

- App:The State Farm mobile app provides a convenient way to file a claim, track its progress, and access other helpful features.

State Farm is committed to providing excellent customer support. You can reach out to them through their website, phone, or local agent for assistance with any questions or concerns. Their website offers a wealth of resources, including FAQs, articles, and videos.

State Farm’s agents are also available to provide personalized guidance and support.

Wrap-Up

Navigating the world of car insurance can be daunting, but with State Farm’s comprehensive coverage and flexible options, you can find the right protection for your new car. By understanding the factors that influence premiums, comparing different plans, and utilizing State Farm’s user-friendly resources, you can confidently secure the insurance that fits your needs and budget.

Remember, a well-informed decision today can save you headaches and financial burdens down the road. So, get started exploring State Farm’s offerings and enjoy the peace of mind that comes with knowing your new car is protected.

FAQ Corner

What factors influence State Farm’s new car insurance premiums?

Several factors contribute to premium costs, including your driving history, vehicle make and model, location, credit score, and even safety features. The more you drive, the higher your risk, and the more expensive your premiums may be. Additionally, vehicles with advanced safety features often receive lower premiums.

How do I file a claim with State Farm for a new car?

State Farm offers multiple ways to file a claim: online through their website, over the phone, or through their mobile app. You’ll need to provide details about the incident, including the date, time, location, and any other relevant information.

What are the benefits of choosing State Farm for my new car insurance?

State Farm is known for its excellent customer service, comprehensive coverage options, and competitive rates. They also offer a wide range of discounts and add-ons to customize your policy.